WhatsApp: The 97% Dominance Rate That Just Triggered the EU’s Fiercest AI Probe Yet

Brussels opens a new antitrust front as WhatsApp blocks rival AIs from reaching its users

On December 4, 2025, the European Commission dropped a regulatory hammer that had been poised to fall for months. In a move that escalates the trans-Atlantic tension between Brussels and Silicon Valley, the EU opened a formal antitrust investigation into WhatsApp. The charge? That Meta is effectively building a walled garden around its 2 billion users, blocking rival artificial intelligence providers like OpenAI and Microsoft from accessing the WhatsApp Business API.

This is not a routine compliance check. It is a fundamental challenge to how Meta intends to monetize the next decade of computing. By allegedly preventing third-party AI chatbots from serving customers on WhatsApp, regulators argue Meta is using its stranglehold on messaging to pre-emptively conquer the AI market. The investigation comes less than a month after Meta was hit with a €797 million fine for tying Facebook Marketplace to its social network—a clear signal that the EU’s patience with “ecosystem locking” has evaporated.

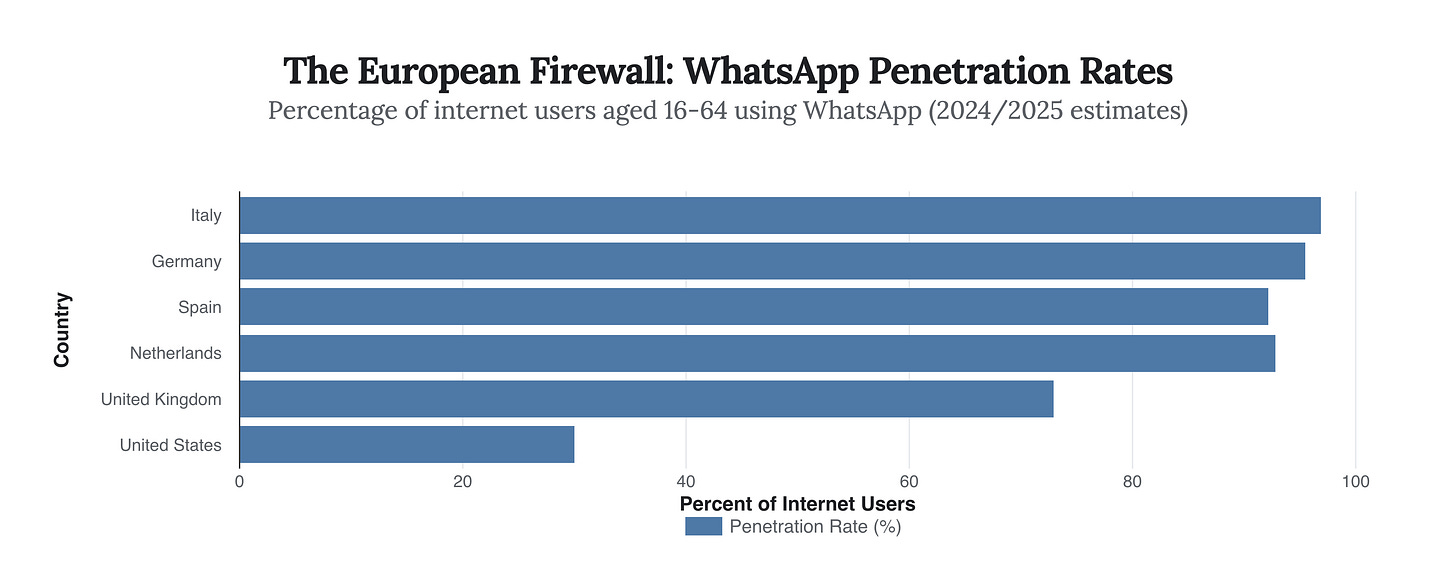

The chart above reveals exactly why this investigation is existential for the EU. In the United States, WhatsApp is a popular alternative; in Europe, it is the infrastructure. With penetration rates hitting 97% in Italy and 95.5% in Germany, WhatsApp effectively is the mobile internet for millions of Europeans. When a platform achieves this level of ubiquity, EU law treats it less like a business and more like a public utility or “gatekeeper.”

Under the Digital Markets Act (DMA), gatekeepers are forbidden from “self-preferencing”—giving their own services an unfair advantage over competitors. Regulators claim that by denying OpenAI’s ChatGPT or Microsoft’s Copilot access to the WhatsApp Business inbox, Meta is artificially steering 450 million European consumers toward its own “Meta AI.”

“We must ensure European citizens and businesses can benefit fully from this technological revolution and act to prevent dominant digital incumbents from abusing their power to crowd out innovative competitors.”

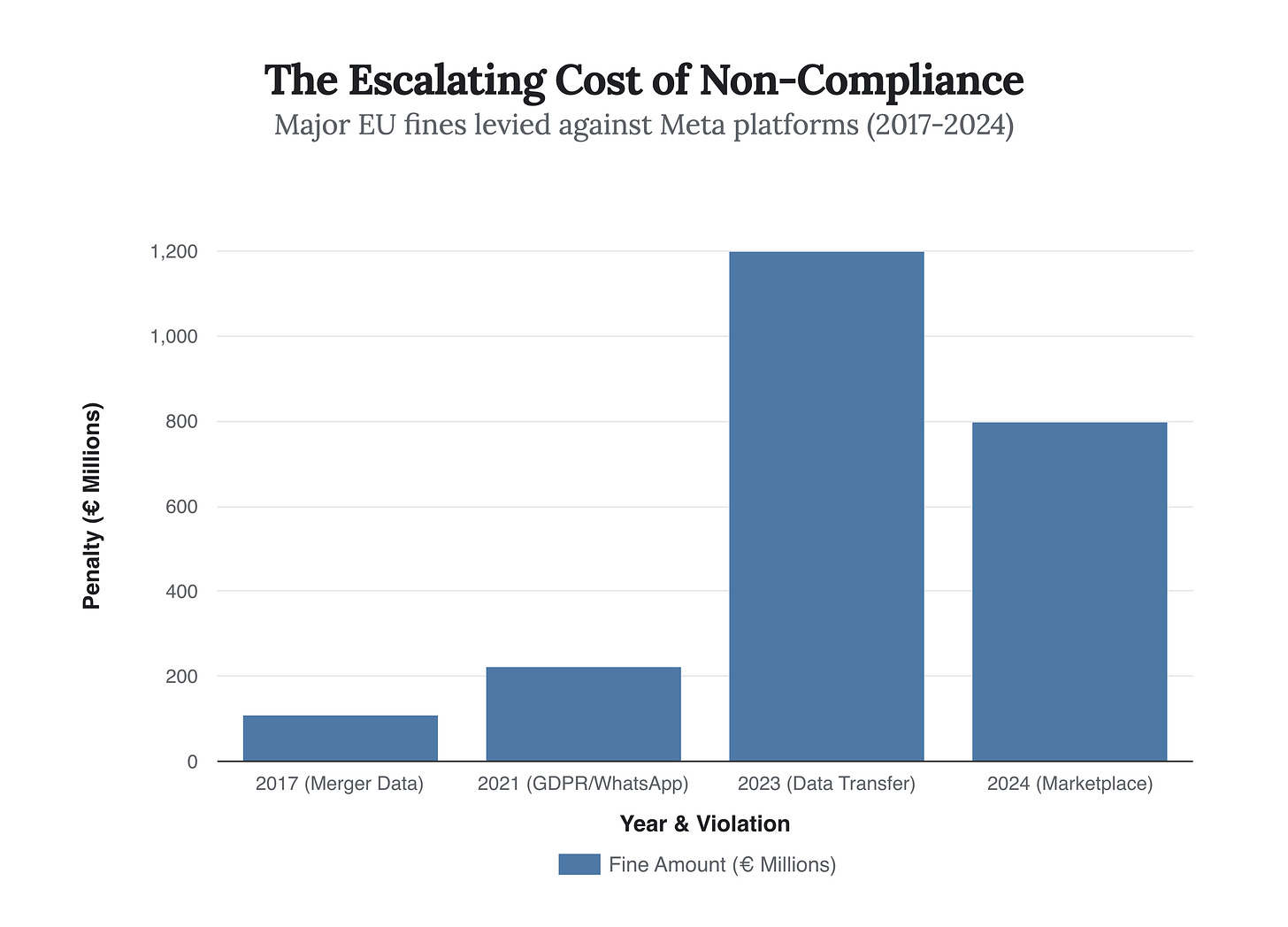

The timing of this probe is no coincidence. It follows a pattern of escalating enforcement that has seen Meta’s fines grow exponentially as its dominance has calcified. What began with “modest” nine-figure penalties for misleading merger data has ballooned into billion-euro judgments regarding data privacy and market abuse.

The stakes for the current AI investigation are even higher than previous fines suggest. While the €797 million penalty in November 2024 for the Facebook Marketplace tie-in was significant, it targeted a mature business model. The current probe targets Meta’s future growth engine. If the Commission finds Meta guilty of abusing its dominant position to suffocate AI rivals, the resulting fine could reach 10% of the company’s global annual turnover—a figure that would dwarf all previous penalties combined.

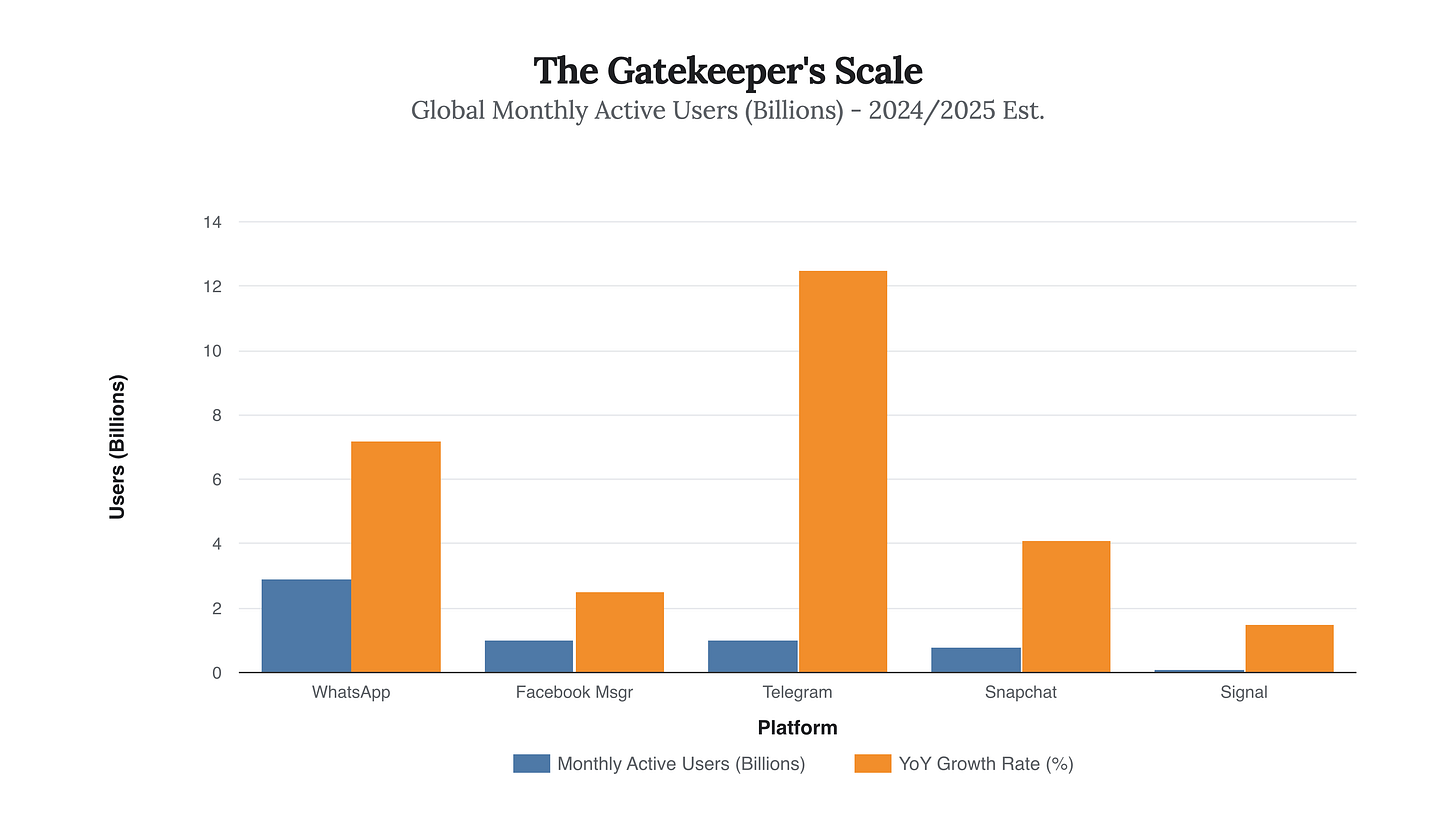

This battle is ultimately about reach. For an AI startup, or even a giant like Microsoft, gaining access to WhatsApp’s user base is the difference between a niche product and a mass-market phenomenon. WhatsApp’s user base is not just large; it is uniquely active and engaged in a way that even its closest competitors cannot match.

As the data shows, WhatsApp’s nearly 3 billion users represent a market roughly three times the size of its nearest independent encrypted rival, Telegram. For the EU Commission, allowing Meta to leverage this massive disparity to win the AI race before it has even started is a non-starter.

Meta has responded by calling the claims “baseless,” arguing that its systems were not designed to support the technical strain of rival AI chatbots. However, for a regulator that has already classified WhatsApp as a “Very Large Online Platform” (VLOP), technical excuses are unlikely to hold water against the mandate for fair competition.

The outcome of this investigation will likely determine whether the future of AI in Europe is an open ecosystem or a closed shop run by a single Silicon Valley giant.