The Statistical Sedative

How GDP’s Triumph Masks Society’s Slow Erosion

While official economic reports trumpet a booming GDP, a deeper look reveals a society quietly eroding under the weight of growing inequality. This article explores how aggregate statistics can become a dangerous sedative, masking the true fractures within our social fabric and calling into question the very definition of ‘prosperity’.

The Allure of the Numbers: A Dangerous Complacency

In an era obsessed with metrics and data, few figures command as much attention and reverence as the Gross Domestic Product. When the US economy recently announced a robust 4.3% annualized growth rate in Q3, the fastest in two years, the news was largely met with a collective sigh of relief and celebration. Pundits lauded the resilience of consumer spending, citing a 3.5% increase, and pointed to rising corporate profits as a sign of vigorous health. On the surface, these numbers paint a picture of undeniable progress, a nation thriving against a backdrop of global uncertainty.

Yet, for many, this official narrative feels increasingly untethered from their lived reality. While the aggregates soar, the daily struggle for stable housing, affordable healthcare, and a secure future remains a grinding constant. This disconnect is not merely an anomaly; it is the symptom of a deeper, more insidious phenomenon: the statistical sedative. We are lulled into complacency by headline figures that, while technically accurate, obscure the profound inequalities and quiet erosions occurring beneath the surface of the economic boom. The question is not whether the economy is growing, but for whom, and at what hidden cost to the collective soul of society.

The Deceptive Mirror of Economic Indicators

The thesis I want to explore here is that our collective reliance on aggregate economic indicators, particularly GDP, has become a dangerous form of self-deception. We’ve allowed these numbers to serve as a proxy for societal well-being, even when they tell only a partial—and often misleading—story. The antithesis arises when we confront the lived experiences that contradict these rosy pronouncements: dwindling savings, rising debt, and a pervasive sense of economic precarity for a significant portion of the population. The synthesis demands a re-evaluation of what constitutes ‘progress’ and ‘prosperity,’ moving beyond mere quantitative growth to embrace qualitative measures of human flourishing and equitable distribution.

Consider the recent data points: a 4.3% GDP growth rate, a 3.5% increase in consumer spending, and a striking 17.9% surge in corporate profits. These are presented as unequivocal triumphs. Yet, the same reports quietly reveal that broader consumer confidence has dipped, and residential investment is down 5.1%. How can an economy be simultaneously ‘booming’ and yet see its foundational elements—homeownership and general public morale— falter? It’s because the ‘boom’ is not broadly shared. It is concentrated, a geyser of wealth erupting in specific sectors and for specific demographics, while others contend with the dust and detritus.

The outstanding discovery of recent decades is that the less we know about something, the more we are inclined to quantify it.

– E.F. Schumacher

Schumacher’s observation rings profoundly true in our current economic discourse. We cling to numbers not because they offer clarity, but because they offer an illusion of control and understanding in an increasingly complex world. We are measuring what is easiest to measure, not necessarily what is most important for a healthy society. This creates a moral blind spot, where the suffering of the many is rendered invisible by the success of the few, all neatly packaged in a positive GDP report.

The Chasm of Uneven Distribution: Wealth’s Echo Chamber

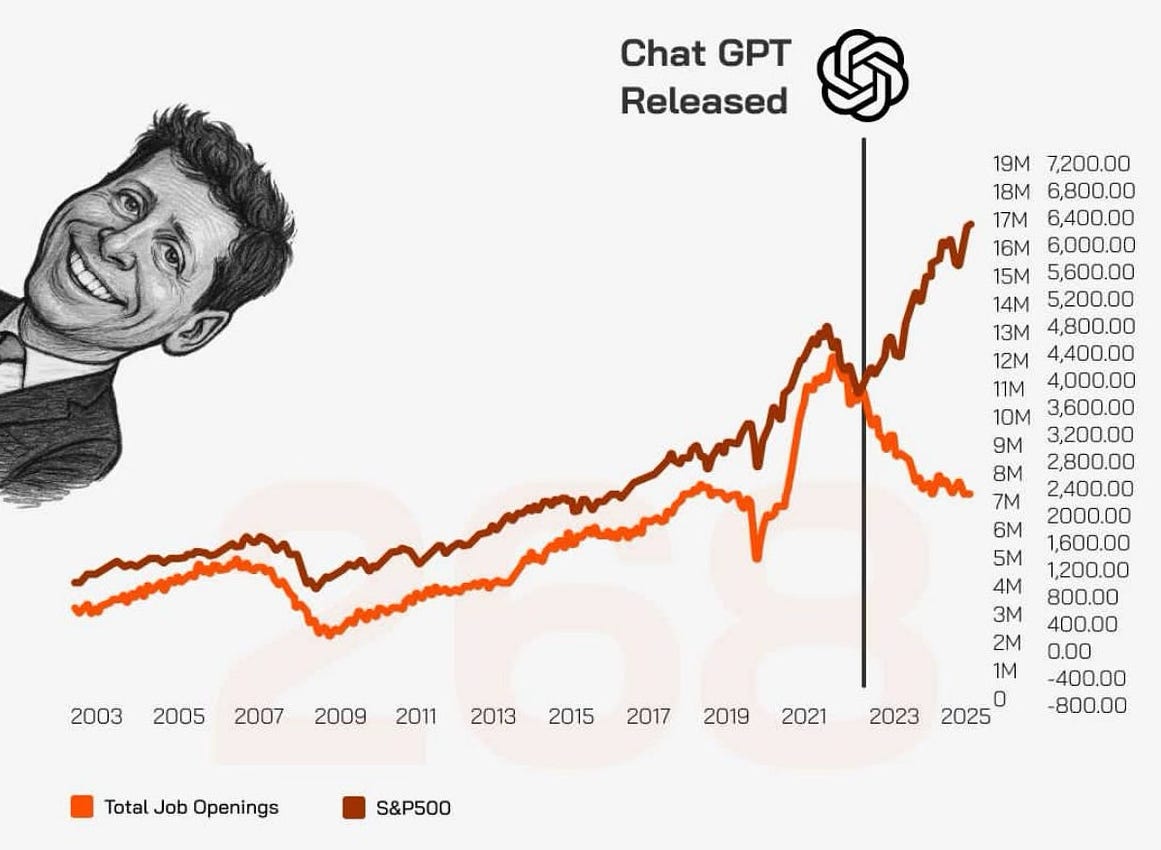

The illusion is further amplified by the uneven distribution of this growth. The prompt states that growth is ‘concentrated in high-income households and tech investments.’ This is where the statistical sedative truly becomes dangerous. It’s not just that the benefits aren’t reaching everyone; it’s that they are actively widening the gap between the affluent and everyone else. High-income households experience increased spending power, fueling the consumer-driven growth, while those outside this gilded circle watch their purchasing power erode due to inflation (currently at 3.4%) and stagnant real wages.

This creates an ‘echo chamber’ of wealth, where capital flows increasingly towards those who already possess it, and innovation (like AI investments) primarily serves to enhance existing power structures rather than uplift the broader populace. The narrative of ‘a rising tide lifts all boats’ becomes a cruel joke when the tide is only rising in certain harbors, leaving many boats beached or sinking. This phenomenon has profound implications for social cohesion. When a significant portion of society feels left behind, despite official pronouncements of prosperity, the seeds of resentment, cynicism, and ultimately, societal instability are sown.

The greatest danger is that in an age of official lying, you can be made to say and believe anything.

– Václav Havel

Havel’s words resonate with chilling accuracy when applied to economic narratives. When the official figures diverge so dramatically from personal experience, trust in institutions erodes. People begin to question the very fabric of truth itself, suspecting that the ‘boom’ is not an objective reality but a carefully constructed narrative designed to maintain the status quo. This is not mere economic discomfort; it is a profound moral and existential crisis where the pursuit of truth is itself undermined.

The Architecture of Apathy: Policy and the Erosion of Empathy

This economic reality is not an accident; it is the outcome of choices, both conscious and unconscious, embedded within our societal architecture. Policies that favor capital over labor, that prioritize abstract growth over human well-being, contribute directly to the uneven distribution we observe. The prospect of ‘potential 2026 boost from tax cuts’ further illustrates this trajectory. While proponents argue such cuts stimulate investment, history often shows they disproportionately benefit the wealthy, further concentrating capital and exacerbating the very inequalities the ‘boom’ supposedly masks.

Moreover, the Federal Reserve’s dilemma regarding interest rates amid data delays from government shutdowns reveals another layer of detachment. Decisions with colossal impact on millions are made based on incomplete information and abstract models, often at the expense of Main Street while Wall Street remains insulated. This system fosters a dangerous form of apathy, where the human element is abstracted into data points, and moral considerations are secondary to market efficiency.

The current economic structure, driven by a narrow definition of success, implicitly encourages a form of ‘cultural illusion.’ We are trained to accept that as long as the line on the graph goes up, everything is fine. This narrative suppresses critical inquiry and discourages empathy for those on the wrong side of the growth curve. The greatest challenge of our time is to pierce through the comforting illusion of aggregated prosperity and confront the inconvenient truth of our fragmented reality.

Reclaiming Authentic Prosperity: Beyond the Bottom Line

If the statistical sedative is blinding us, how do we open our eyes? The path forward requires a fundamental shift in our understanding of prosperity itself. It means moving beyond a singular focus on GDP and embracing a more holistic framework that values human flourishing, social equity, ecological sustainability, and community resilience.

This involves several key steps:

Redefining Metrics: Advocate for indicators that measure distribution, well-being, environmental health, and social capital, not just raw economic output. Metrics like the Genuine Progress Indicator (GPI) or the Human Development Index (HDI) offer alternative lenses through which to view societal health.

Prioritizing Local Economies: Invest in and support local businesses and community-based initiatives that recirculate wealth within a geographical area, rather than extracting it for distant shareholders. This strengthens local resilience and fosters a sense of shared fate.

Ethical Consumption and Investment: Consciously choose to support companies that uphold ethical labor practices, environmental stewardship, and fair wages. Demand transparency and accountability from corporations and financial institutions.

Engaging in Political Action: Hold elected officials accountable for policies that promote equity and broad-based prosperity. Challenge tax cuts for the wealthy and advocate for social safety nets and infrastructure that benefit all citizens.

Cultivating Critical Awareness: Develop a healthy skepticism towards official narratives, especially those based solely on abstract numbers. Seek out diverse perspectives and engage in critical analysis of economic data, asking always: ‘Who benefits, and who pays the cost?’

The synthesis of these actions can help us build a society where prosperity is not just an aggregate statistic for the few, but a lived reality for the many. It is a slow, difficult process, but one essential for the survival of genuine social cohesion.

A Call to Awaken: Beyond the Illusion

The US economy’s rapid growth presents us with a profound paradox: a boom that, for too many, feels like a bust. The aggregated numbers, while impressive on paper, function as a statistical sedative, numbing us to the underlying erosion of social equity and the widening chasm of lived experience. This is not merely an economic issue; it is a moral challenge to our collective conscience. We are confronted with the universal human weakness of denial, choosing to believe a convenient narrative rather than confronting an uncomfortable truth.

The stakes are existential. If we continue to define prosperity solely by quantitative growth for the few, we risk fragmenting our society beyond repair, sacrificing genuine human connection and shared purpose on the altar of abstract profit. The historical gravity of thinkers like Polanyi and Havel reminds us that the disembedding of economics from society, or the divorce of official truth from lived experience, inevitably leads to profound and dangerous consequences.

We must cultivate the intellectual depth to understand the limitations of our metrics and the emotional fire to demand a more just and equitable world. It is time to look beyond the alluring numbers, to see the human faces behind the statistics, and to build an economy that truly serves the flourishing of all, not just the privileged few. The illusion of shared prosperity is a dangerous comfort; only by confronting the truth of our economic divides can we hope to build a more resilient and humane future.

Exceptional work interrogating GDP as the metric of choice. The Schumacher quote about quantifying what we know least about is devastatingly accurate here. I've watched policymakers in emerging markets use rising GDP to justify cuts to social programs while infant mortality climbed, the numbers creating political cover for decisions that harmed actual people. What's particuarly interesting is how this statistical illu sion feeds itself, corporate profit surges get reinvested in assets that boost GDP further while median household purchasing power stagnates.

I’m increasingly chilled by the easy isolation of exceedingly wealthy. Seeing the world through their Zuckerberg glasses. Finally I see what dystopia looks like.