The Shutdown Weapon and the Capitol’s Self-Inflicted Wound

The government shutdown has evolved from a rare constitutional anomaly into a recurring political weapon, wielded with increasing frequency and severity. This manufactured crisis, born from legislative impasse, is no longer a mere inconvenience confined to the Washington beltway.

It is a significant source of systemic risk, inflicting direct economic damage, degrading national security readiness, eroding trust in public institutions, and creating strategic opportunities for global adversaries. For industry leaders, investors, and policymakers, understanding the second- and third-order effects of this self-inflicted wound is critical for navigating an increasingly volatile political and economic landscape. This briefing deconstructs the anatomy of a shutdown, quantifies its cascading impacts, and provides a strategic outlook on future fiscal brinkmanship.

The Architecture of Paralysis: Deconstructing the Shutdown Mechanism

A government shutdown is not a failure of the entire U.S. government but a targeted halt of specific federal functions. The process is rooted in the Antideficiency Act, which bars federal agencies from spending money that Congress has not appropriated. When lawmakers fail to pass the 12 annual appropriations bills that fund “discretionary” spending, a funding gap occurs, forcing non-essential operations to cease. This distinction between discretionary and mandatory spending is the central fault line.

Discretionary vs. Mandatory Spending: The Annual Battlefield

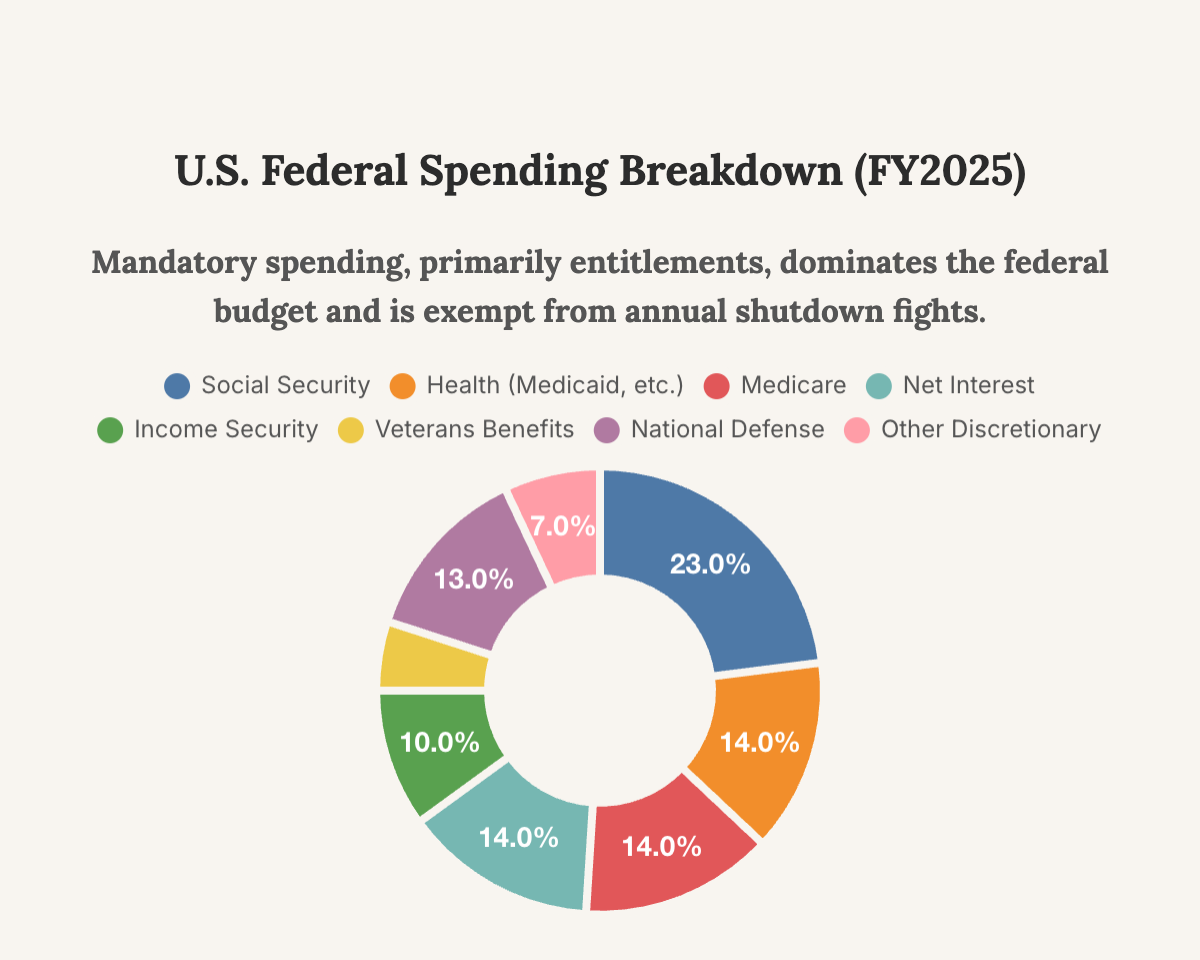

Roughly two-thirds of the federal budget is classified as mandatory spending. This includes entitlement programs like Social Security, Medicare, and Medicaid, as well as interest payments on the national debt. These funds are authorized by existing laws and continue to flow during a shutdown, largely insulating beneficiaries from immediate impact. The annual appropriations battle is fought over the remaining portion—discretionary spending—which covers nearly everything else, from national defense and homeland security to scientific research, infrastructure, and education.

This chart illustrates the fundamental budget structure. The majority of federal spending is on autopilot, while the annual political conflict centers on the smaller discretionary portion that funds core government operations, including defense.

A Modern Political Weapon

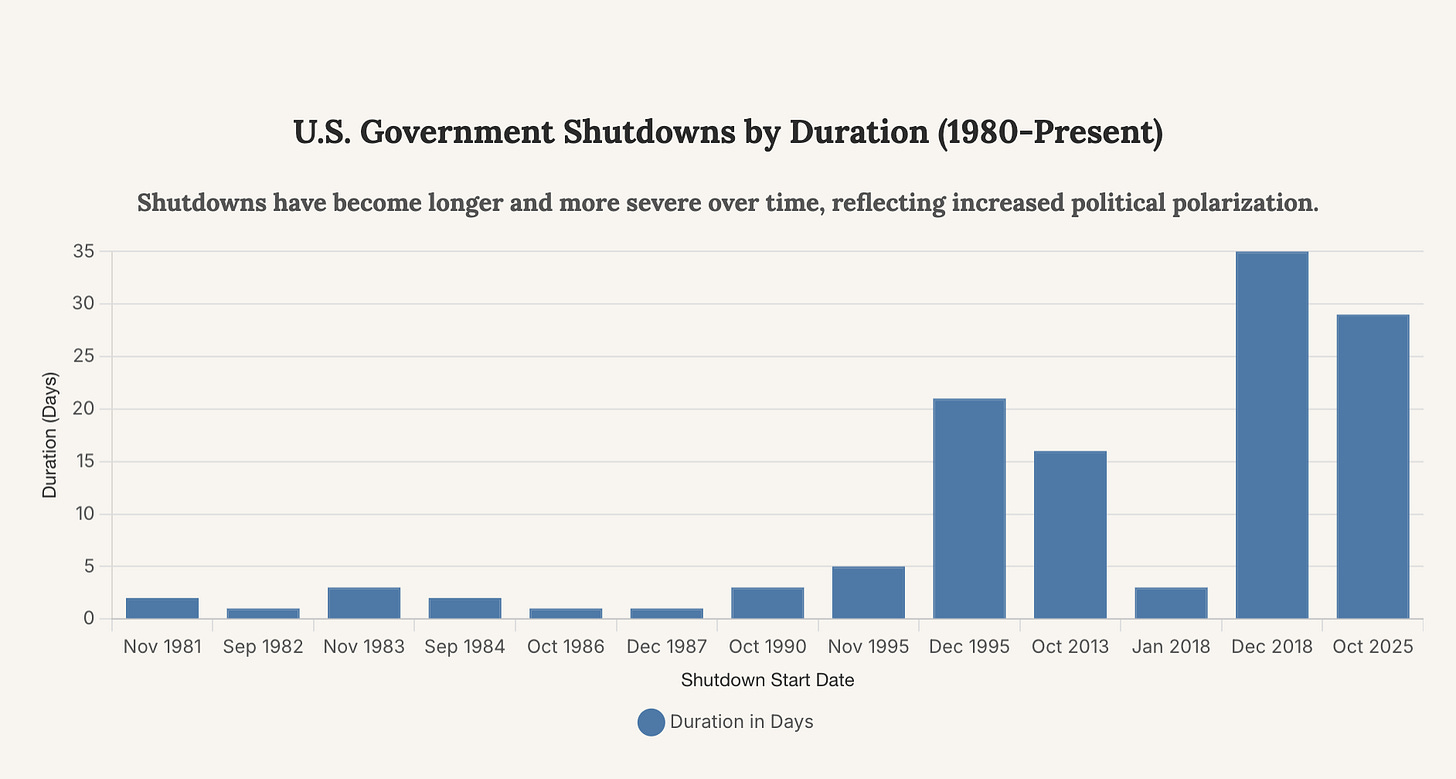

While funding gaps occurred in the 1970s, the modern interpretation forcing widespread shutdowns began with legal opinions from Attorney General Benjamin Civiletti in 1980 and 1981. Since then, shutdowns have become a tool of political leverage, with their frequency and duration escalating, particularly in recent decades. The longest shutdowns in U.S. history—35 days in 2018-2019 and 21 days in 1995-1996—account for more than half of all shutdown days combined, signaling a strategic shift towards longer, more disruptive standoffs.

This chart visualizes the trend toward more protracted shutdowns. Early events were brief, measured in hours or a few days. Recent decades have seen multi-week closures become a recurring feature of the political landscape.

The Economic Ripple Effect: Quantifying the Damage

A shutdown’s economic impact extends far beyond the salaries of furloughed federal workers. It creates a drag on GDP, disrupts private sector activity, and injects uncertainty into the economy, chilling investment and consumer spending. The damage is both immediate and, in some cases, permanent.

Direct Economic Costs

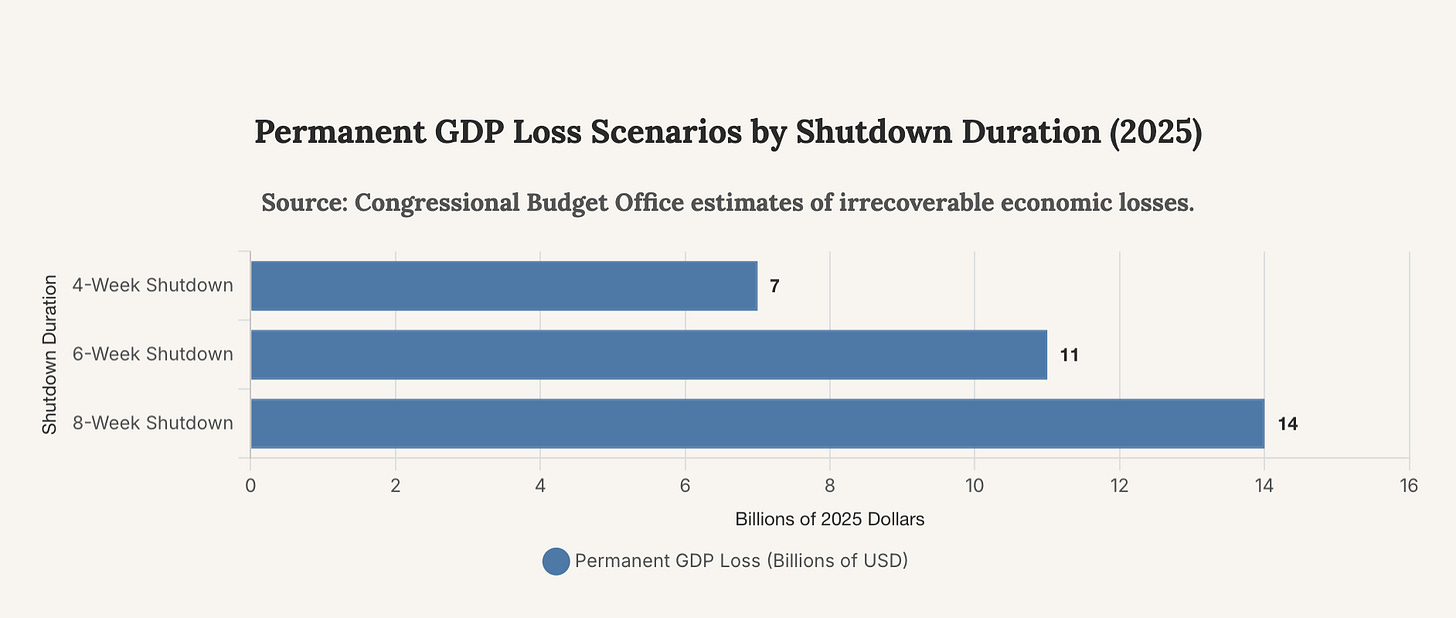

The Congressional Budget Office (CBO), a nonpartisan agency, provides the most credible estimates of the direct costs. Recent analysis indicates that a shutdown costs the U.S. economy between $7 billion and $14 billion, depending on its length. The 35-day shutdown of 2018-2019 permanently erased an estimated $3 billion from the economy. These losses stem from several factors:

Lost Productivity: Furloughed federal employees are not working, and while they have historically received back pay, the work that went undone represents a permanent loss of output.

Delayed Spending: Government agencies halt procurement and payments to contractors. This freezes a significant channel of government spending into the private sector, hitting small and medium-sized businesses particularly hard.

Reduced Consumer Confidence: The uncertainty created by a shutdown, especially for federal workers and contractors facing delayed paychecks, dampens consumer spending and overall economic confidence.

As this CBO data shows, the permanent economic damage accelerates the longer a shutdown persists. A two-month shutdown could permanently wipe $14 billion from the U.S. economy.

Second-Order Effects on the Private Sector

The disruption to government services creates significant friction for private businesses. Companies in regulated industries, such as pharmaceuticals and finance, face delays in approvals. The tourism industry suffers as national parks and monuments close. Perhaps most critically, the shutdown halts the release of key economic data from agencies like the Bureau of Labor Statistics and the Census Bureau, which the Federal Reserve and private sector analysts rely on to make critical decisions. This creates a fog of uncertainty that can paralyze investment.

“It is pernicious because over time, these government shutdowns and ‘almost-shutdowns’ and ‘almost-defaults’ lead to a loss of public confidence in the ability of the government to function and to get things done.”

The Corrosion of State Capacity: A Long-Term Threat

Beyond the immediate economic headlines, shutdowns inflict a deeper, more corrosive damage on the long-term capacity and effectiveness of the U.S. government. This institutional decay has profound implications for national security, scientific leadership, and the rule of law.

Hollowing Out the Federal Workforce

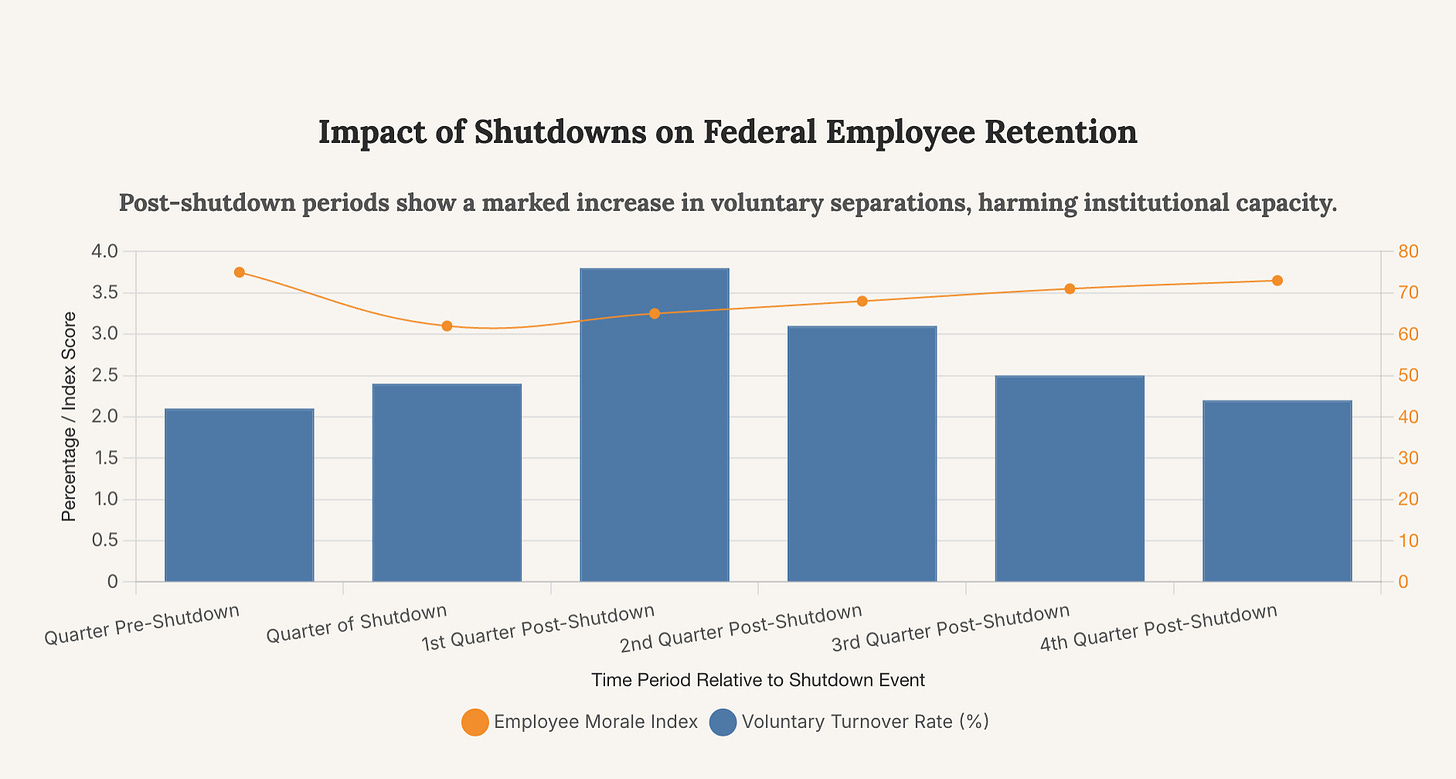

Repeated shutdowns severely damage morale within the federal workforce. Furloughing employees and forcing others to work without pay sends a message that their work is not valued. This has a tangible impact on recruitment and retention. Research shows a significant spike in voluntary turnover at federal agencies following a shutdown, particularly among younger, more mobile employees with valuable skills. A federal agency with 10,000 employees can expect to lose an additional 500 workers in the quarter after a shutdown. This brain drain makes it harder for the government to compete with the private sector for top talent in critical fields like cybersecurity, AI, and biomedical research, ultimately diminishing the quality of government services.

This chart illustrates the dual impact on the federal workforce: a sharp, immediate drop in morale followed by a lagging but significant increase in employees choosing to leave government service.

National Security and Global Standing

While active-duty military personnel remain on duty during a shutdown, they are forced to work without pay, creating significant financial hardship and stress for service members and their families. More broadly, the furlough of civilian Department of Defense personnel disrupts everything from intelligence analysis to procurement and maintenance schedules. National security experts warn that the spectacle of a shutdown projects an image of American dysfunction and unreliability to both allies and adversaries.

“The message that this sends to our allies, to the country domestically, the message that this sends to our enemies is not good. I think that’s a very real national security threat.” - Bryan Stern, national security expert.

The disruption extends to law enforcement and homeland security. While essential personnel at agencies like the Capitol Police, FBI, and TSA remain on the job, their support staff are furloughed, and training, investigations, and grant disbursements to local law enforcement can be delayed. This creates vulnerabilities and slows the operational tempo of the nation’s security apparatus.

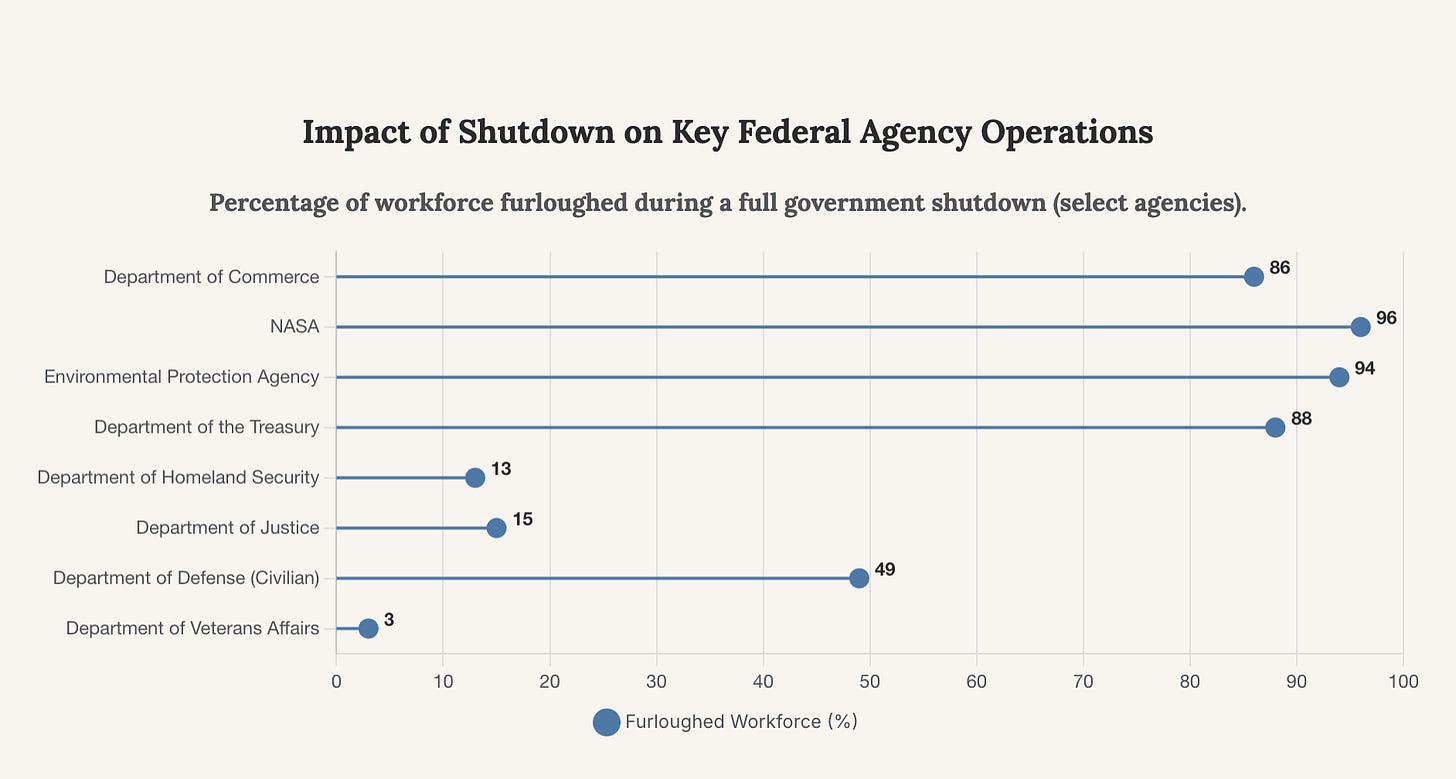

This chart shows the wildly different impacts across agencies. While front-line security agencies are largely exempt, scientific and economic agencies are decimated, halting research and regulatory functions.

Strategic Outlook: The Future of Fiscal Brinkmanship

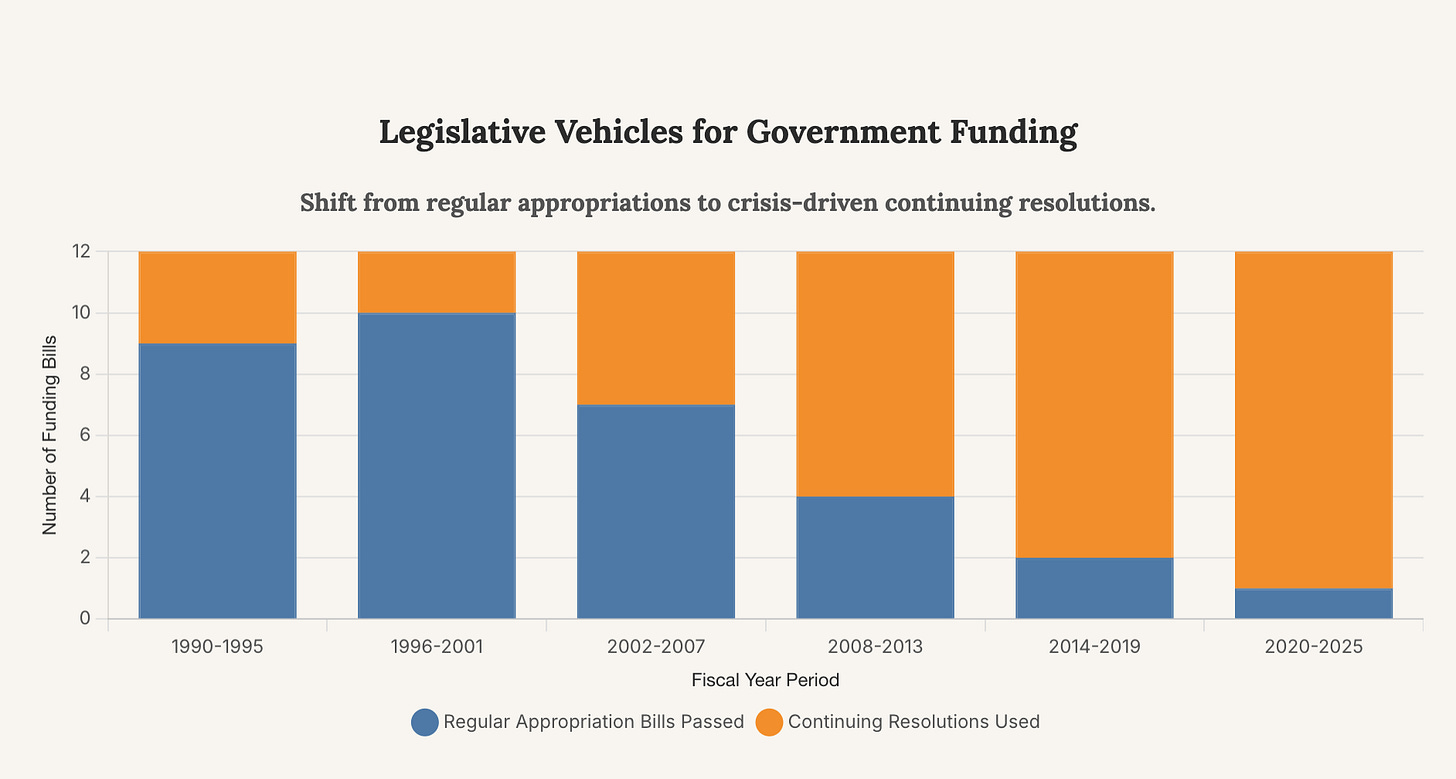

The institutionalization of the shutdown as a political tactic suggests that the risk of future fiscal crises is high. The underlying drivers—deep partisan polarization, narrow congressional majorities, and the erosion of bipartisan norms—show no signs of abating. The reliance on last-minute, short-term continuing resolutions (CRs) to avoid shutdowns has replaced the traditional, deliberative appropriations process, turning budgeting into a perpetual cycle of crisis management.

Key Signposts to Monitor

For leaders and investors, several key indicators will signal the likelihood and potential severity of future shutdowns:

Debt Ceiling Negotiations: The next debate over raising the federal debt ceiling will be a critical flashpoint. It is often linked to budget negotiations and carries an even greater risk of catastrophic economic consequences.

Intra-Party Cohesion: The ability of party leadership in the House and Senate to control their respective caucuses is a key variable. Breakdowns in party discipline, particularly from smaller, more ideologically rigid factions, can derail fragile budget agreements.

Appropriations Process Timeline: A failure by Congress to pass individual appropriations bills through committee on a regular schedule (known as “regular order”) is a leading indicator that they will resort to massive, last-minute omnibus bills or CRs, increasing the probability of a shutdown.

This chart highlights the decay of the normal budget process. Congress increasingly fails to pass individual spending bills, relying instead on stopgap measures that fuel instability and brinkmanship.

Ultimately, the recurring use of government shutdowns represents a profound failure of governance. It inflicts unnecessary economic hardship, weakens the machinery of the state, and damages America’s standing in the world. For decision-makers in the private and public sectors, treating these events as mere political theater is a strategic error. They are a feature, not a bug, of the current political environment, and their cascading risks must be priced into any serious economic or strategic forecast. The greatest long-term cost of the shutdown weapon is the erosion of the very institutional capacity required to govern a complex nation in a dangerous world.