The Great Re-Platforming

An Intelligence Briefing on Amazon’s AI-Driven Workforce Transformation

Amazon’s recent and ongoing corporate job cuts, totaling over 41,000 since late 2022, are not merely a reaction to post-pandemic over-hiring or short-term economic headwinds. They represent a deliberate, strategic recalibration of the company’s entire operational structure.

CEO Andy Jassy is steering the technology giant through a profound transformation, moving from a human-managed, technology-assisted enterprise to an AI-native organization. This intelligence briefing deconstructs the multifaceted strategy behind these workforce reductions, analyzing the key drivers, the specific business units being reshaped, and the long-term implications for the competitive landscape. The core thesis is that Amazon is systematically ‘re-platforming’ its corporate functions, trading human capital for AI-driven efficiency and redirecting the immense cost savings into the capital-intensive race for generative AI supremacy. This is a calculated, albeit painful, move to build a leaner, more agile organization engineered for the next decade of technological disruption.

The Anatomy of a Strategic Cull: Deconstructing the Layoffs

The workforce reductions at Amazon have been neither random nor uniform. They have been executed in targeted waves, reflecting a clear strategic logic focused on eliminating redundancies, flattening management hierarchies, and reallocating resources from mature or underperforming sectors to high-growth, AI-centric initiatives.

Wave Analysis: From Pandemic Correction to AI Pivot

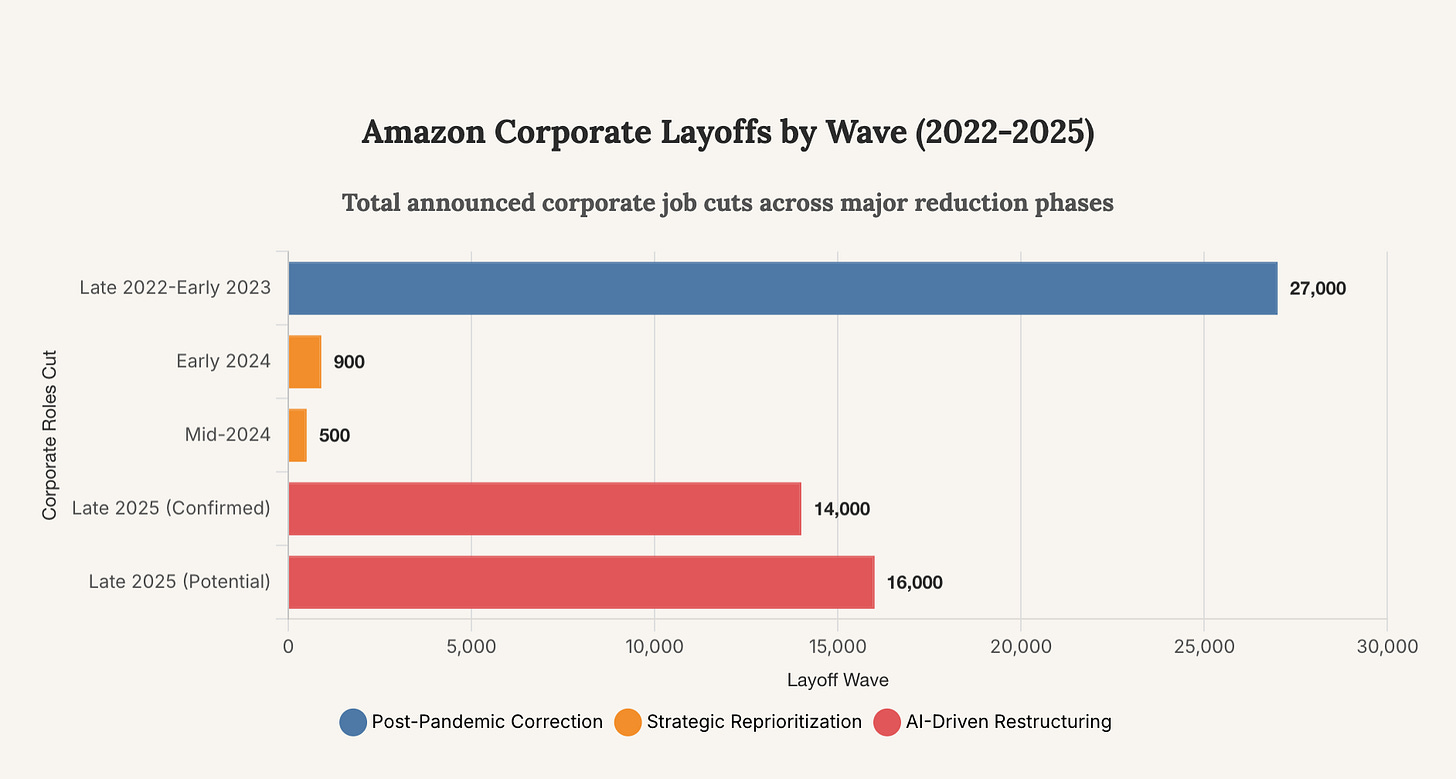

The initial wave of layoffs in late 2022 and early 2023, which cut over 27,000 jobs, was largely framed as a correction for the massive hiring surge during the COVID-19 pandemic. However, the subsequent and ongoing cuts in 2024 and 2025, culminating in a reduction of at least 14,000 corporate roles, have a different character. These are explicitly linked to CEO Andy Jassy’s vision of a leaner, less bureaucratic company where AI automates significant portions of corporate work. The rhetoric from leadership has shifted from ‘right-sizing’ to ‘restructuring for innovation speed’.

This chart illustrates the distinct phases of Amazon’s workforce reduction. The initial large cut corrected for pandemic-era expansion, while the more recent, substantial wave is directly tied to the company’s strategic pivot toward AI and operational efficiency.

Targeted Divisions: Where the Axe is Falling

Analysis of the affected divisions reveals a clear pattern. The cuts have been concentrated in areas ripe for automation and in divisions where investment is being deprioritized. Key areas include:

People Experience and Technology (HR): This division has seen significant cuts as AI tools increasingly automate recruiting, onboarding, and other administrative functions.

Retail and Devices: Mid-level management in the core retail business has been heavily impacted, aligning with Jassy’s goal of reducing bureaucracy. The devices division, including Alexa and related products, has also faced repeated cuts, signaling a strategic reassessment of its consumer hardware ambitions.

Prime Video & MGM Studios: Despite massive content spends in the past, these divisions have seen hundreds of layoffs as Amazon seeks greater efficiency and ROI in its media operations.

Twitch: The live-streaming platform has laid off a staggering 35% of its workforce, indicating a major strategic rethink for the costly division.

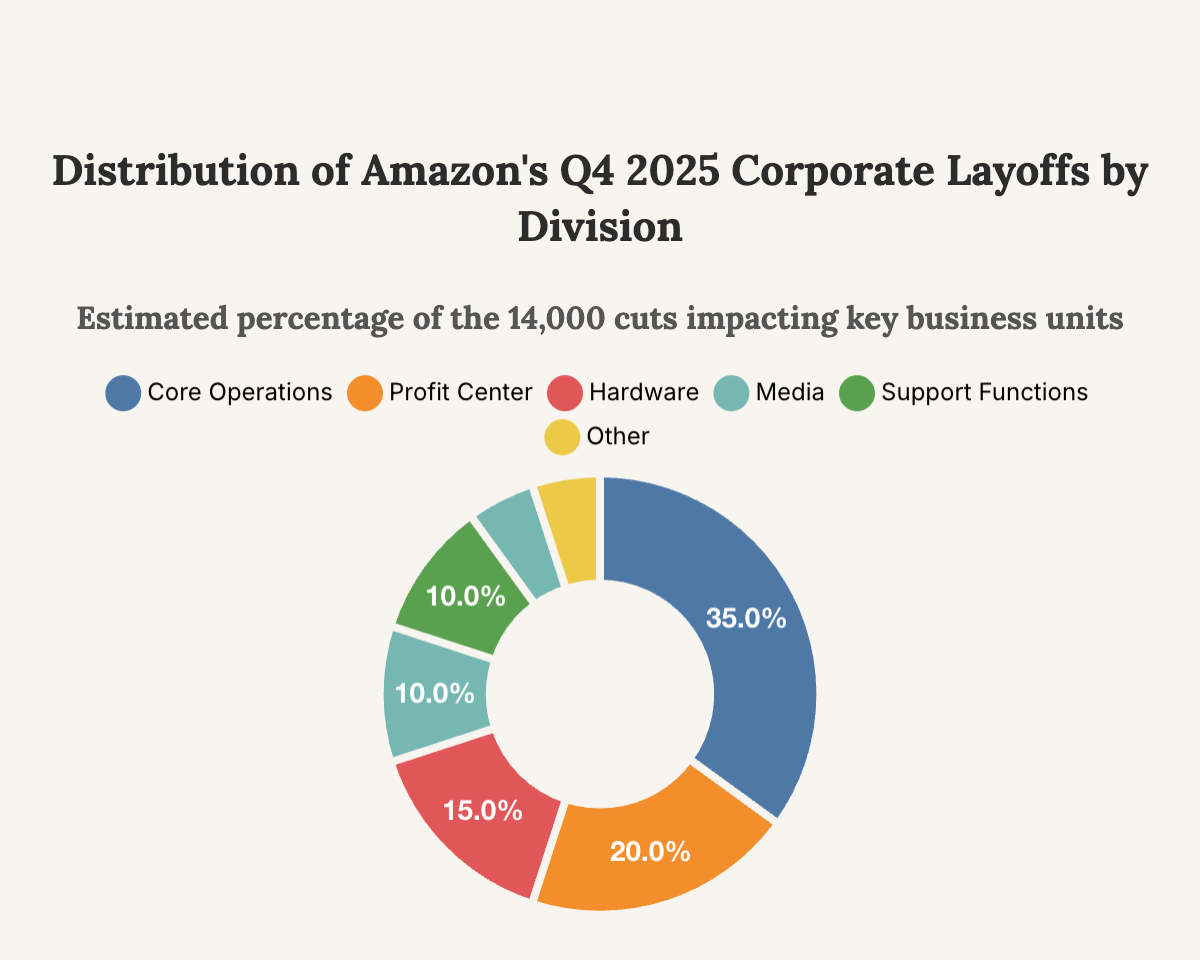

This chart visualizes the strategic allocation of the most recent job cuts. The heavy concentration in Retail and AWS underscores the dual focus on streamlining core operations while optimizing the company’s primary profit engine for a new, AI-centric market reality.

The AI Imperative: Trading Headcount for Compute Power

The central pillar of Amazon’s new strategy is the reallocation of capital from salaries to silicon. The cost savings from reducing tens of thousands of corporate roles are being directly funneled into the exorbitant expense of building out the infrastructure required to compete in the generative AI arms race. This is not merely about using AI to improve existing processes; it’s about freeing up billions in operational expenditures to fund the capital expenditures needed to acquire the essential hardware, primarily high-end GPUs from Nvidia.

“We will need fewer people doing some of the jobs that are being done today, and more people doing other types of jobs. It’s hard to know exactly where this nets out over time, but in the next few years, we expect that this will reduce our total corporate workforce as we get efficiency gains from using AI extensively across the company.” - Andy Jassy, CEO, Amazon

The GPU Bottleneck and Margin Pressure

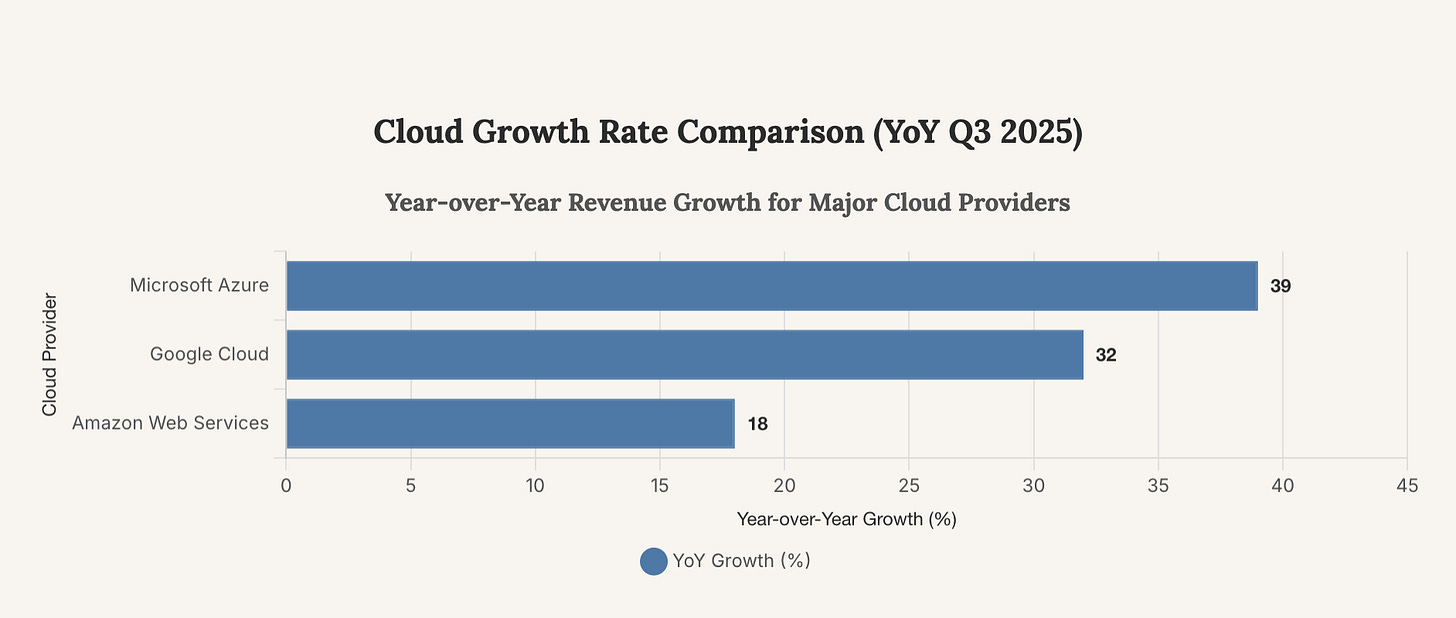

Amazon Web Services (AWS), the company’s profit engine, faces intense pressure. While still a market leader, its growth has slowed relative to competitors like Microsoft Azure and Google Cloud. A significant factor is the global shortage and high cost of GPUs needed to train and run large AI models. Analysts suggest Amazon is ‘trading talent for GPUs’ to protect AWS margins while meeting the insatiable demand for AI compute. The company cannot afford to both maintain its historical corporate headcount and invest the necessary tens of billions into AI infrastructure without severely impacting profitability.

This chart highlights the competitive pressure on AWS. Slower growth relative to its main rivals provides a powerful incentive for Amazon to cut costs in other areas to fund the massive capital expenditures required to accelerate its AI capabilities and regain market momentum.

Redefining Roles: The Rise of the AI-Augmented Workforce

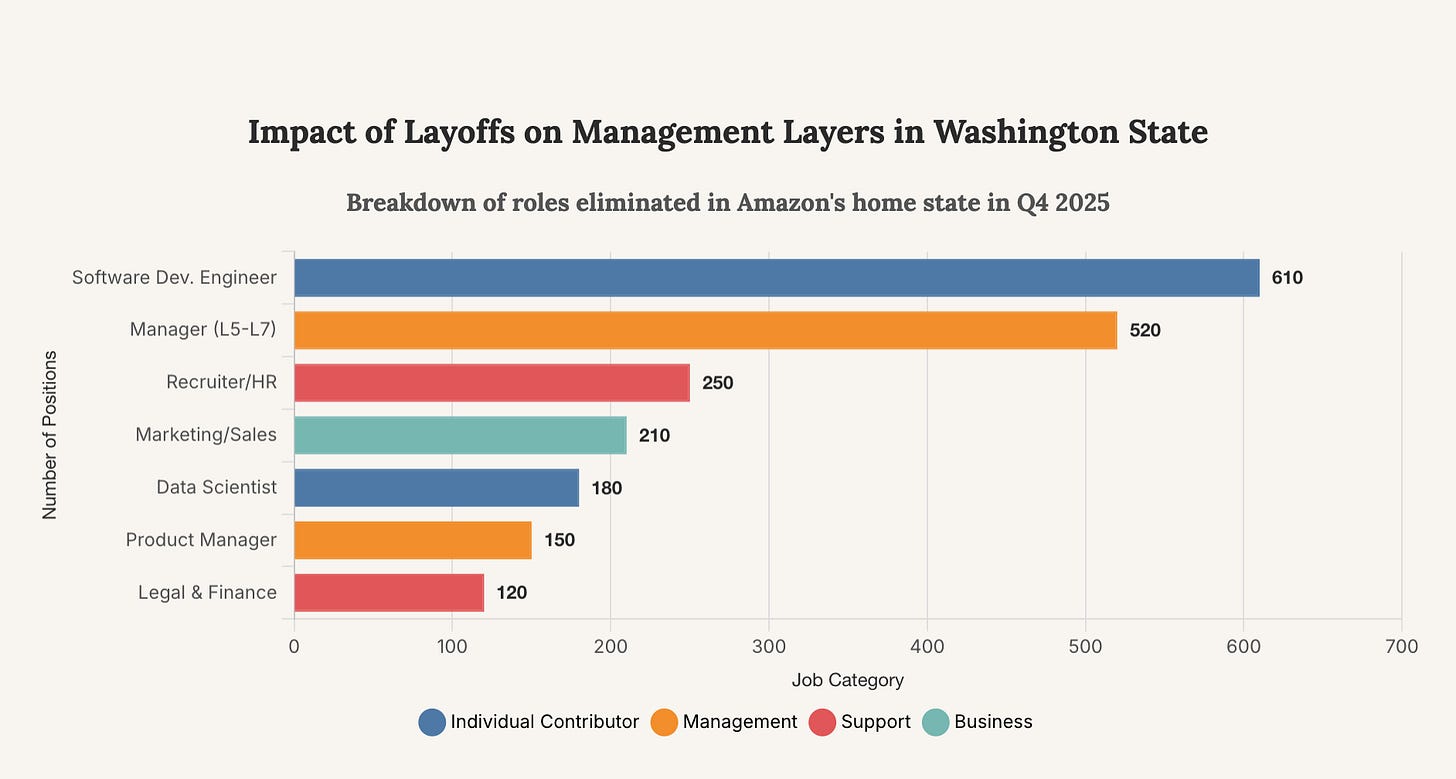

The layoffs are not just about elimination but also transformation. The roles being cut are often those involving repetitive data analysis, project management, and administrative oversight—tasks increasingly handled by AI. For instance, the significant reduction in software development engineer (SDE) and manager roles coincides with the adoption of advanced AI coding assistants. The company’s goal is a leaner structure with fewer management layers, where remaining employees leverage AI tools to achieve higher output.

“This signals that Amazon is realising enough AI-driven productivity gains within corporate teams to support a substantial reduction in force.” - Sky Canaves, Senior Analyst, eMarketer

This data from Amazon’s home state filings provides a granular view of the restructuring. The deep cuts to both software engineers and mid-level managers strongly indicate a strategic move to flatten the organizational chart and automate core development and oversight functions.

Strategic Implications and Future Outlook

Amazon’s aggressive restructuring carries significant risks and opportunities. The immediate effect is a more streamlined cost structure and a clear signal to investors of a commitment to fiscal discipline and AI investment, which has been met with a generally positive, if muted, stock market reaction.

Winners and Losers

The clear winners in this transition are the divisions at the heart of Amazon’s AI strategy: AWS, AI research and development teams, and robotics/automation. These areas will continue to see investment and hiring. The losers are corporate functions susceptible to automation, consumer-facing divisions with high overhead and unclear profitability paths (like Devices and parts of Media), and mid-level managers whose roles are being rendered obsolete by flatter, AI-driven team structures.

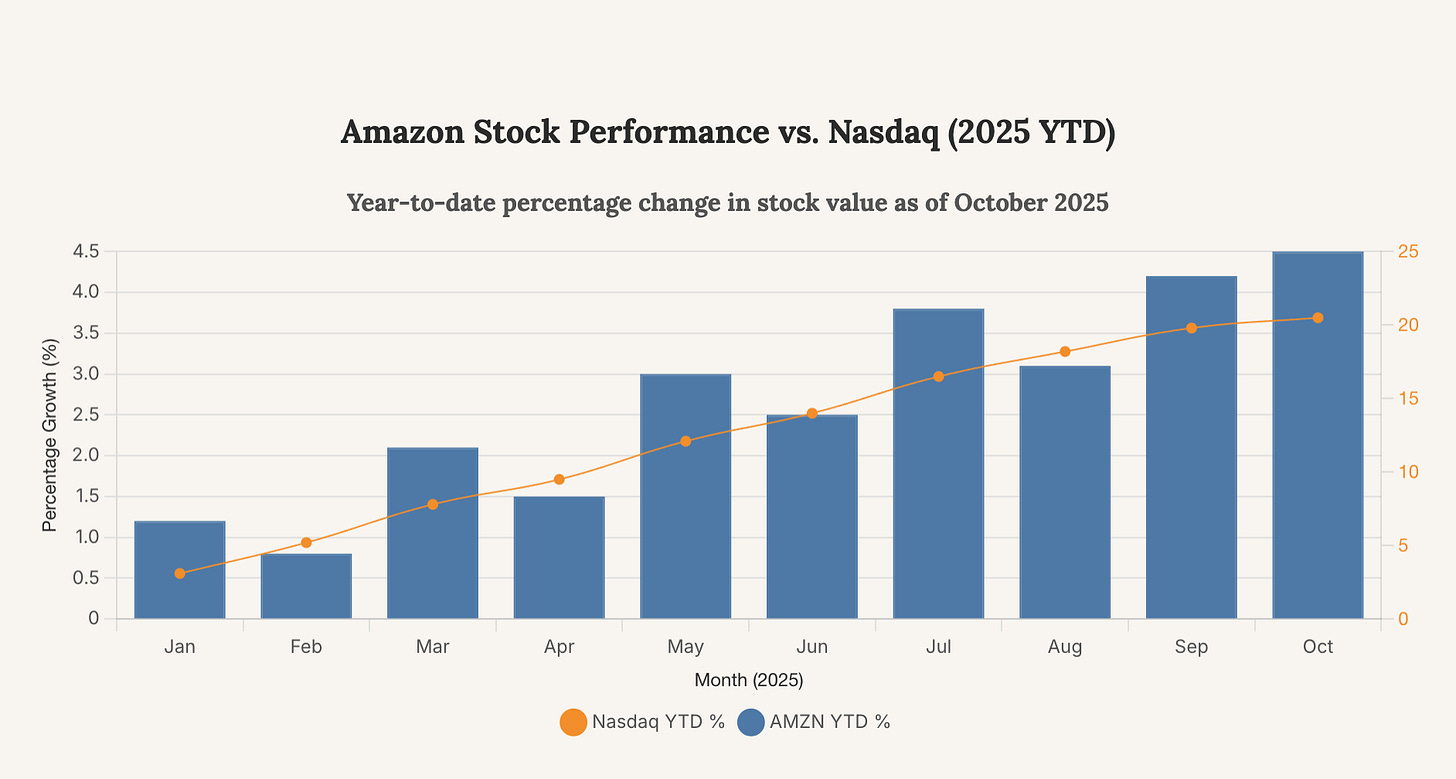

Despite the massive layoffs, Amazon’s stock has underperformed the tech-heavy Nasdaq index in 2025. This suggests that while investors appreciate the cost-cutting, they are still waiting for the AI-driven strategy to translate into accelerated growth and a clear competitive advantage before fully rewarding the company.

Forward-Looking Predictions

1. Continuous, Rolling Adjustments: Expect Amazon to move away from large, headline-grabbing layoff events toward a model of continuous, smaller-scale workforce adjustments. As AI tools become more sophisticated, roles will be eliminated on a team-by-team basis, making restructuring a perpetual state of being rather than a discrete event. Further cuts into 2026 have already been signaled.

2. AWS as the Primary Battleground: The success of this entire strategy hinges on AWS. The capital freed up by corporate layoffs must translate into a demonstrable acceleration in AWS’s AI product offerings and market share. Watch for major announcements around custom silicon (Trainium and Inferentia) and exclusive partnerships to gauge its competitive response to Microsoft and Google.

3. A New Corporate Blueprint: Amazon is setting a precedent for other large technology companies. If this AI-driven restructuring successfully boosts margins and innovation speed, expect competitors to accelerate their own plans to trade human capital for AI automation, potentially leading to a broader wave of white-collar job cuts across the sector.

In conclusion, the tens of thousands of pink slips at Amazon are not just evidence of a company trimming fat; they are the building blocks of a new, leaner, and more formidable corporation. Andy Jassy is making a high-stakes bet that the future of competitive advantage lies not in the size of a company’s workforce, but in the power of its AI infrastructure and the efficiency of its AI-augmented employees. The transition will be turbulent, but the objective is clear: to engineer an organization that can operate with the speed and agility of a startup while wielding the scale and resources of a global titan. The key strategic insight is that Amazon is no longer just an e-commerce or cloud company; it is fundamentally restructuring itself to become a capital-intensive AI infrastructure provider that uses its other businesses to fund and leverage that core mission.