The Frozen Fortune Dilemma

Machiavelli’s Warning on the Seizure of Russia’s Sovereign Wealth

Imagine a vault of gold, locked away not by choice but by the iron fist of international sanctions, its contents whispering promises of justice for a war-torn nation while echoing warnings of global financial chaos. This is the reality of Russia’s frozen assets—some $300 billion in sovereign wealth immobilized since the 2022 invasion of Ukraine.

As we stand on the precipice in late 2025, with Ukrainian President Volodymyr Zelenskyy pleading for their use and EU leaders dithering in Brussels, the dilemma cuts to the core of our shared human frailty: the temptation to right one wrong by risking a cascade of others. Drawing from Machiavelli’s timeless counsel in The Prince—that princes must weigh the immediate gain against the enduring peril—let’s unpack this modern conundrum dialectically, fusing cold data with the hot urgency of a world teetering on escalation.

The Lure of Reparations: Why Seizing the Assets Feels Like Moral Imperative

At first glance, the thesis is compelling: Why let aggressors profit while victims bleed? The frozen assets, primarily held in Western financial institutions, represent a direct counter to Russia’s war machine. Historical precedents abound—think of the reparations imposed on Germany after World War I, or the asset seizures from Iraq in the 1990s. In this vein, advocates argue that transferring these funds to Ukraine isn’t theft but restitution, a way to make the perpetrator pay for reconstruction and defense.

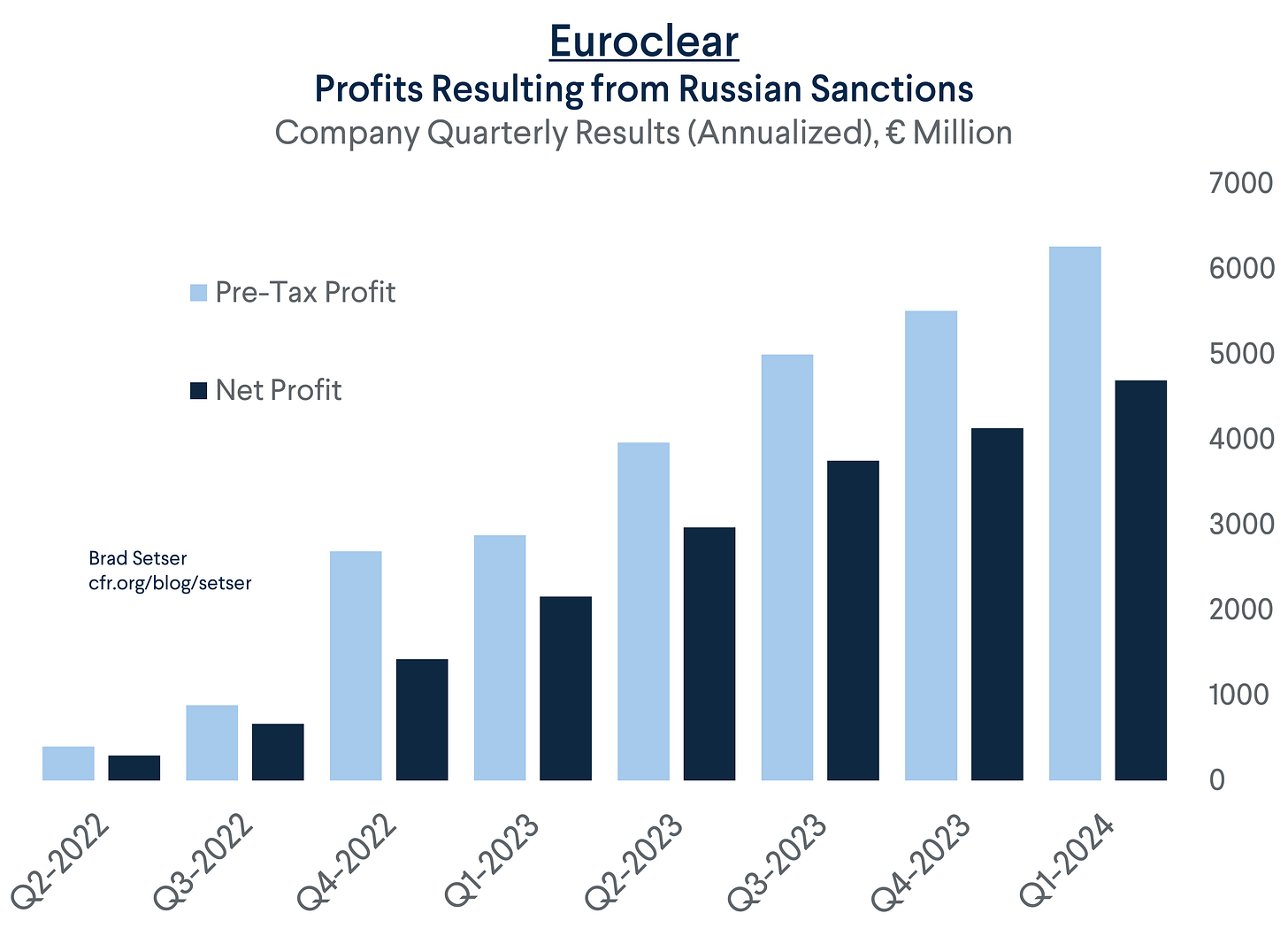

Consider the numbers: The EU alone holds about €200 billion ($232 billion) of Russian central bank reserves, with profits from these assets accruing at a staggering rate. Euroclear, the Belgian depository managing much of this, reported annualized pre-tax profits from sanctioned assets climbing to nearly €7 billion in early 2024, before taxes siphoned off a portion.

This interest alone could fund critical aid. The European Commission has proposed channeling these windfalls into a €140 billion loan program for Ukraine, potentially unlocking fresh capital for weapons and rebuilding. Zelenskyy himself framed it urgently in October 2025: Europe is “close to a decision” on transferring these assets, warning that delay equates to complicity in a “war of attrition” that “makes no sense.” It’s a mirror to our collective conscience—don’t we all recognize the injustice of letting billions sit idle while cities crumble?

“The aggressor pays for the defence.”

ArmyInform, Ukrainian Ministry of Defense media, highlighting Denmark’s model using profits from frozen assets to fund artillery for Ukraine.

Yet, this thesis elevates the stakes to existential levels. Without such funding, Ukraine’s resilience falters, potentially emboldening autocrats worldwide. As philosopher Hannah Arendt might remind us, inaction in the face of tyranny breeds more tyranny, connecting this crisis to the timeless struggle for freedom against oppression.

The Shadow of Retaliation: Unraveling the Global Financial Web

But here’s the antithesis, stark and sobering: Seizing these assets could shatter the fragile trust underpinning the international financial system. Machiavelli warned that “men ought either to be well treated or crushed,” but crushing here risks a backlash that engulfs us all. Legal hurdles loom large—international law protects sovereign assets from outright confiscation, viewing them as countermeasures only in extreme cases. The EU’s own discussions reveal fractures: Belgium, home to Euroclear, has balked at proposals, fearing lawsuits that could drain its reserves and trigger a broader crisis.

Data underscores the peril. Frozen assets are distributed unevenly, with Belgium holding the lion’s share at $193 billion, followed by France at $71 billion and others trailing.

If Russia retaliates—as it has threatened, potentially seizing €33 billion from Euroclear in Moscow or filing suits in Hong Kong and Dubai—the dominoes fall. Reuters reports this could lead to Euroclear’s license revocation, emptying its €37 trillion in holdings and sparking a global meltdown.

Economic weaknesses amplify the dread. With U.S. aid to Ukraine evaporating—dropping from peaks in 2022 to near zero in 2025—Europe bears the brunt, but joint debt alternatives strain already indebted nations.

Hungary’s Viktor Orban warns that using these assets “could become a prelude to war,” highlighting alliances with skeptics like the Czech Republic and Slovakia that complicate consensus. This isn’t just policy; it’s a reflection of our universal hubris—the belief we can bend rules without consequence, only to invite apocalypse.

“If Brussels decides to seize frozen Russian assets... the Central Bank of Russia could file so many lawsuits that the Belgian central bank would be forced to revoke the company’s license. This would lead to a global financial crisis.”

Reuters, outlining the retaliatory risks in a potential asset grab.

Framing it culturally, this antithesis draws from the Cold War’s lessons: Mutual assured destruction wasn’t just nuclear; it was economic. Tampering with sovereign wealth invites de-dollarization pushes from BRICS nations, eroding Western hegemony and validating readers’ unspoken fears of a multipolar world gone awry.

Bridging the Ice: Toward a Synthesis of Prudence and Justice

So, how do we synthesize this dialectic? Not through reckless seizure or timid inaction, but a calibrated approach that honors moral authority while safeguarding stability. The EU’s current pivot—using assets as collateral for loans without outright confiscation—offers a middle path. As German Finance Minister Christian Lindner suggested, this preserves property rights while unlocking €140 billion for Ukraine’s needs. It’s Machiavellian cunning at its finest: Achieve the end without the full peril.

Yet, urgency demands more. With profits from frozen assets projected to yield billions annually, channeling interest alone could sustain aid without principal risks. Fresh data from 2025 shows these accruals stabilizing at high levels, providing a sustainable stream.

This synthesis connects timeless wisdom—Aristotle’s golden mean between extremes—with today’s crisis, urging a framework where reparations flow without unraveling the system.

The true trap isn’t the frozen assets themselves, but our failure to act with both head and heart—risking freedom’s death by a thousand delays.

In this conversational vein, let’s admit: We’ve all felt that pull between justice and caution, whether in personal disputes or global affairs. But as witnesses like Zelenskyy attest, the stakes are imminent—existential survival for Ukraine, moral integrity for the West. By threading this needle, we honor the prophets of prudence like Machiavelli, ensuring that today’s decisions don’t prophecy tomorrow’s tyranny.

😌🏺⚖️🔔 Great Stuff,

"Applied Philo-Sophia!"