The Aristocracy of Time: How the 401(k) System Engineered a New Serfdom

A comprehensive guide to understanding the widening wealth gap in retirement savings, analyzing why the current system fails the working class and what moral framework is needed to fix it.

The Architecture of Exclusion

I want you to look past the spreadsheets for a moment and consider the moral architecture of our retirement system. We are told that the 401(k) is a vehicle for democratization, a way for every worker to own a piece of the means of production. But in practice, it has become a mechanism for exclusion. The latest reports indicate a disturbing trend: participation rates for lower-income workers are dropping, not because they lack the will to save, but because they lack the capacity to sacrifice the present for the future.

When you earn between $15,000 and $50,000 a year, every dollar diverted to a retirement account is a dollar removed from immediate necessities—food, rent, healthcare. The system effectively asks the poor to starve themselves today to avoid starving tomorrow. Meanwhile, high earners not only have the surplus capital to invest but are rewarded with employer matches—essentially free money that compounds over time. We have built a system where the wealthy are subsidized for their solvency, while the poor are penalized for their precarity.

The Burden of Risk

The shift from defined benefit pensions to defined contribution plans was sold as “freedom,” but it was actually a massive transfer of risk. In the past, the institution bore the burden of market volatility. Today, you bear it alone. If the market crashes the year you retire, the system shrugs. This individualization of risk is a profound moral failure, one that the philosopher Simone Weil anticipated when she wrote about the human need for security.

Security is an essential need of the soul. Security means that the soul is not under the weight of fear or terror, except by an accidental conjunction of circumstances and for limited and exceptional periods of time. Fear and terror as permanent states of the soul are practically mortal diseases.

– Simone Weil, The Need for Roots

By tethering our survival in old age to the whims of the market and our ability to navigate it, we have inflicted a permanent state of low-level terror on the working class. This is not freedom; it is a form of psychological serfdom.

The Illusion of Choice in a Constrained Reality

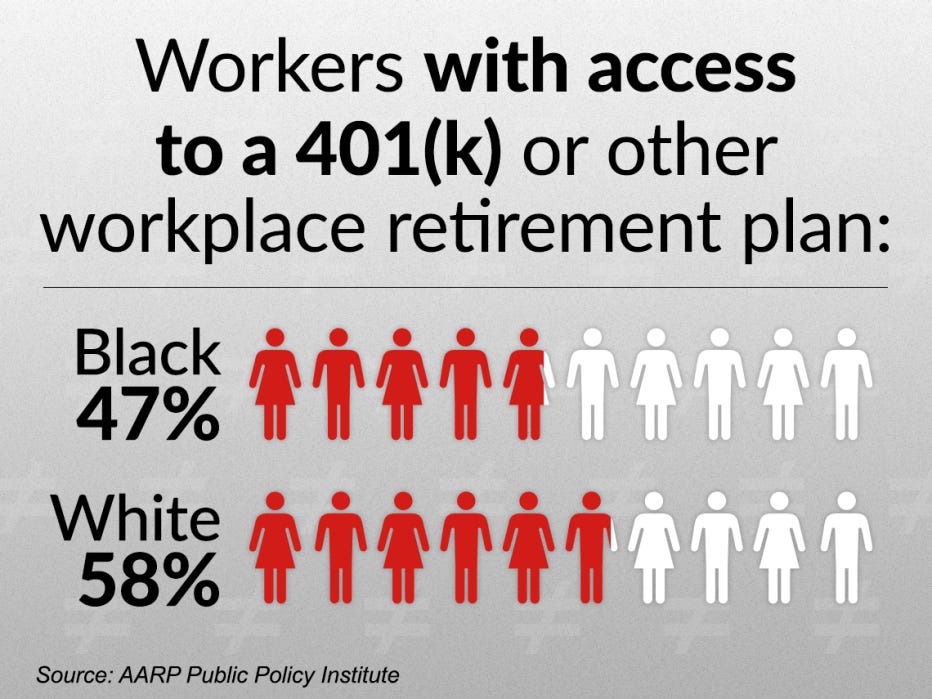

We must dismantle the idea that this outcome is the result of poor choices. To choose to save, one must first have options. For millions of Americans, the “choice” is between paying for a child’s medication or contributing to a 401(k). To call this a choice is a linguistic sleight of hand designed to absolve the system of its cruelty. The disparity is further racialized and class-bound, with non-college households holding a fraction of the wealth of their educated peers. This is not an accident; it is the logical conclusion of a system that values capital over labor.

Society refuses to turn itself into a museum of the past, and the old have no place in it... The old man is the victim of a fate he has to suffer but did not choose.

– Simone de Beauvoir, The Coming of Age

We are creating a future where the “old man” or “old woman” is not just a victim of biological fate, but of economic design. We are engineering a geriatric underclass.

Reclaiming the Future: A New Social Contract

So, where do we go from here? The solution is not merely “financial literacy”—teaching a drowning man to swim does not stop the flood. We need a fundamental reimagining of the social contract regarding old age. This means acknowledging that retirement security is a public good, not a private luxury. It involves decoupling dignity from market performance.

Practical steps include advocating for universal retirement accounts that are portable and decoupled from specific employers, expanding Social Security to provide a true living wage rather than a poverty-line subsistance, and challenging the tax structures that disproportionately benefit the wealthy’s savings. But beyond policy, we need a shift in consciousness. We must refuse to accept the premise that your worth in your final years is determined by your market value in your prime.

Key Takeaways

The Meritocracy Lie: The current retirement system rewards surplus income, not hard work, effectively subsidizing the wealthy while ignoring the structural barriers facing the working class.

Risk Transfer: The transition to 401(k)s shifted the burden of market volatility from institutions to individuals, creating a permanent state of insecurity for those without a financial cushion.

Moral Necessity: Security in old age must be reframed as a fundamental human right, essential for the health of the soul, rather than a reward for financial savvy.

Structural Reform: Real change requires systemic shifts—universal accounts and strengthened public safety nets—rather than just individual behavioral adjustments.