Is the AI Gold Rush a Trap? What Jensen Huang's Prophecy Tells Us About Our Future?

You've probably heard the buzz: AI is everywhere, and companies like Nvidia are leading the charge. But is this a genuine revolution or a bubble waiting to burst? Nvidia CEO Jensen Huang is incredibly bullish, even as some investors get cold feet. I'm diving into his arguments and the market's doubts to help you understand what's really going on and why it matters for all of us. Let's unpack the evidence and see if we can separate the hype from the reality.

The AI Divide: Are We Witnessing a Revolution or a Mirage?

It feels like everyone is talking about AI. One day, it's the most exciting thing since the internet; the next, you hear whispers of an impending crash. This creates a real dilemma, doesn't it? On one hand, you have visionaries like Nvidia's CEO Jensen Huang, confidently declaring a 'new industrial revolution' and predicting trillions in AI spending. On the other, the stock market shows signs of 'fatigue,' and some experts even warn that investors might be 'overexcited.'

I've been grappling with this question: Is the current AI frenzy a legitimate path to an incredible future, or are we just watching another bubble inflate? This isn't just about stock prices; it's about how our world will be shaped. What we decide now, individually and collectively, will determine whether AI truly delivers on its promise or falls short due to misjudgment. Let's dig into the core arguments from both sides to find some clarity.

Jensen Huang's Bold Vision: Why He Sees a Trillion-Dollar Future

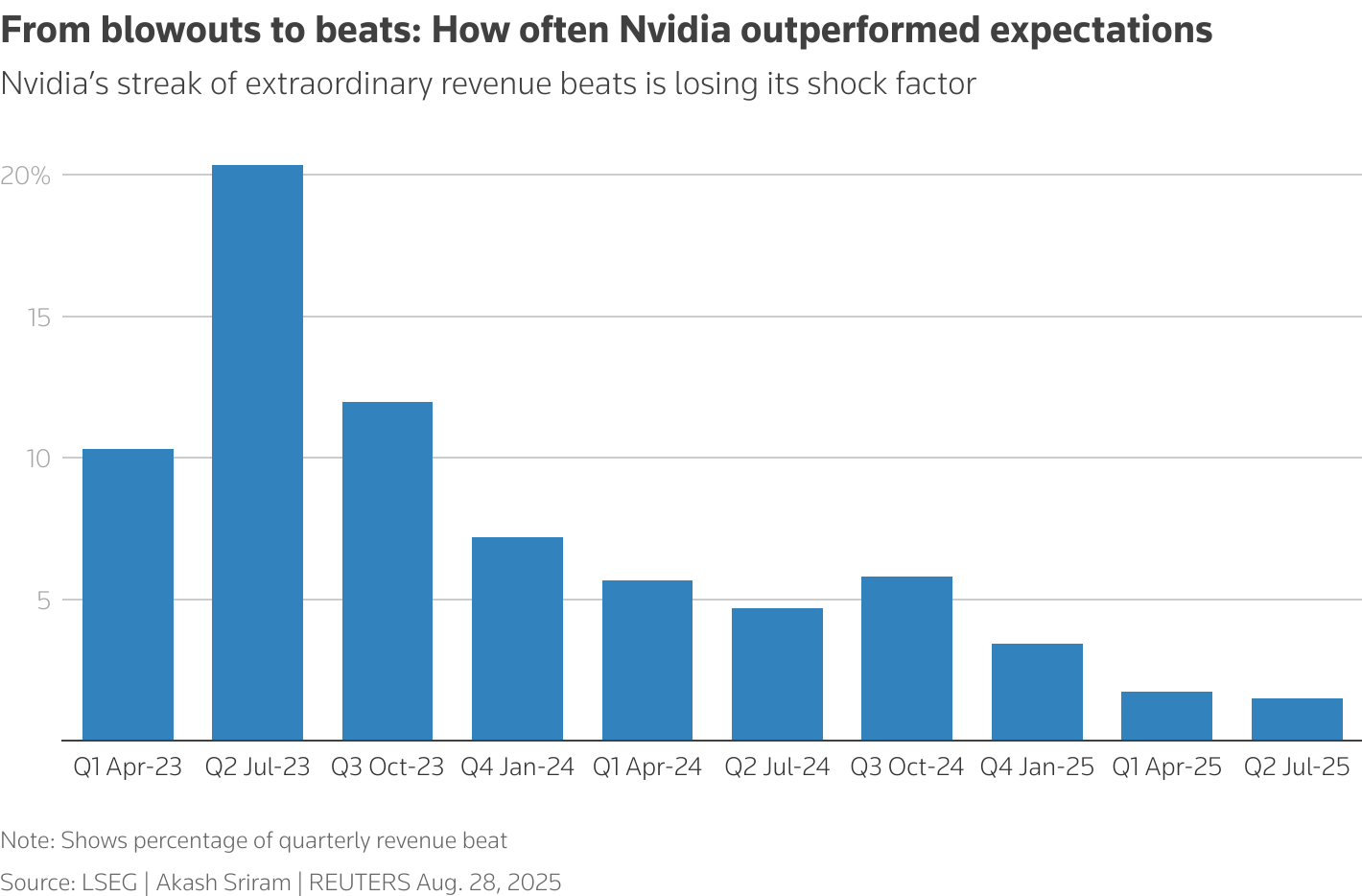

When Nvidia reported its Q3 sales forecast, some investors got a bit nervous. The shares dipped, and there was talk of slowing growth. But Jensen Huang, Nvidia's CEO and founder, didn't flinch. In fact, he doubled down on his belief that the AI boom is just getting started, envisioning a multi-trillion-dollar market by the end of the decade. He sees a 'new industrial revolution' underway, with an incredible $3 trillion to $4 trillion in AI infrastructure spending expected.

What's fueling this optimism? Huang points to massive demand from Big Tech companies and data center owners, often called 'hyperscalers.' He mentioned that major customers like Microsoft and Amazon are projected to spend around $600 billion on data center capital this year alone, and Nvidia is positioned to capture a significant chunk of that. For instance, he estimates Nvidia could claim about $35 billion from a single $60 billion data center project! He even shared a telling detail: a customer outside China recently bought $650 million worth of Nvidia's H20 chips – a version specifically made for the Chinese market. His message is clear: 'The buzz is: everything sold out.'

"A new industrial revolution has started. The AI race is on. We see $3 trillion to $4 trillion in AI infrastructure spend by the end of the decade."

– Jensen Huang, Nvidia CEO

The Counterpoint: Why Some See Cracks in the AI Gold Rush

While Huang is painting a rosy picture, not everyone is buying it. That initial drop in Nvidia's stock after the Q3 forecast signals a degree of market skepticism. Investors were clearly disappointed, especially since the sales outlook excluded potential revenue from China – a massive market where trade tensions are causing uncertainty. It reminds me of how quickly sentiment can shift, even for a company as dominant as Nvidia.

It's not just Nvidia; other AI-focused stocks have also shown 'signs of fatigue.' And remember OpenAI CEO Sam Altman, who warned that investors might be 'overexcited' about AI? These are not small voices. They suggest that perhaps the hype has gotten ahead of the reality, or that the market is more sensitive to geopolitical issues and the actual pace of commercialization than the most ardent evangelists. This perspective makes a lot of sense if you've seen tech booms come and go. It's about tempering expectations and recognizing that even revolutionary technologies face bumps in the road.

Why This Debate Shapes Your Future

So, why should you care about this high-stakes debate between a visionary CEO and the cautious market? Because the outcome will profoundly impact our economy, our jobs, and even the products and services we use every day. If Huang is right, and this is truly an industrial revolution, then massive investment now will yield incredible advancements and opportunities. Pulling back would be a strategic blunder, potentially leaving us behind.

However, if the market's skepticism is justified, then continued unchecked enthusiasm could lead to a bubble, similar to the dot-com bust, which could hurt investments and slow down innovation significantly. The invisible war for reality is being fought right now, defining whether we are building a robust new foundation or inflating a dangerous illusion. It’s a classic dialectic: the thesis of boundless potential meets the antithesis of market caution, and we're all waiting to see the synthesis emerge. This isn't just about stocks; it’s about understanding the forces shaping the future you'll live in.

"The true tragedy is not that we suffer, but that we are in denial about our suffering."

– Slavoj Žižek

Your Guide to Navigating the AI Frontier: Separating Fact from Fiction

Given these conflicting perspectives, how should you, as an engaged citizen and perhaps an investor, approach the AI frontier? First, cultivate a healthy skepticism. Don't simply believe the hype, but also don't dismiss the incredible potential. Look for concrete evidence, not just promises. When evaluating AI opportunities, consider the long-term trends versus short-term market fluctuations.

For businesses, it means intelligently investing in AI where it genuinely solves problems or creates new value, rather than simply chasing the latest buzzword. For individuals, it's about understanding how AI might impact your industry and skill set, preparing for a future that will undoubtedly be different. Remember, we are in the 'early stages' of this boom. That means there's still a lot of uncertainty, but also immense opportunity for those who can critically engage with the evidence and adapt their thinking. Stay informed, ask tough questions, and don't let either extreme – blind optimism or paralyzing fear – dictate your understanding of this transformative technology.