Igniting a “Golden Age” of Alliance and Ambition?

But the Data Exposes a Relationship Built on Trade Imbalances, Rising Stakes, and China’s Shadow.

In the opulent glow of Tokyo’s Akasaka Palace, President Donald Trump and Sanae Takaichi—Japan’s first female prime minister—shared a handshake that echoed with promise. Trump called her “a winner” and “one of the greatest,” invoking their mutual friend Shinzo Abe while signing deals on rare earth minerals and pledging a “new golden age” for the alliance. Warm words, military pageantry at Yokosuka naval base, even shared laughs over baseball. Yet beneath the optics lies a partnership forged in necessity, strained by economics, and tested by geopolitics. The realities? A U.S. trade deficit swelling to $62.7 billion last year, Japan’s defense budget surging toward 2% of GDP, and a desperate bid to break China’s stranglehold on critical minerals.

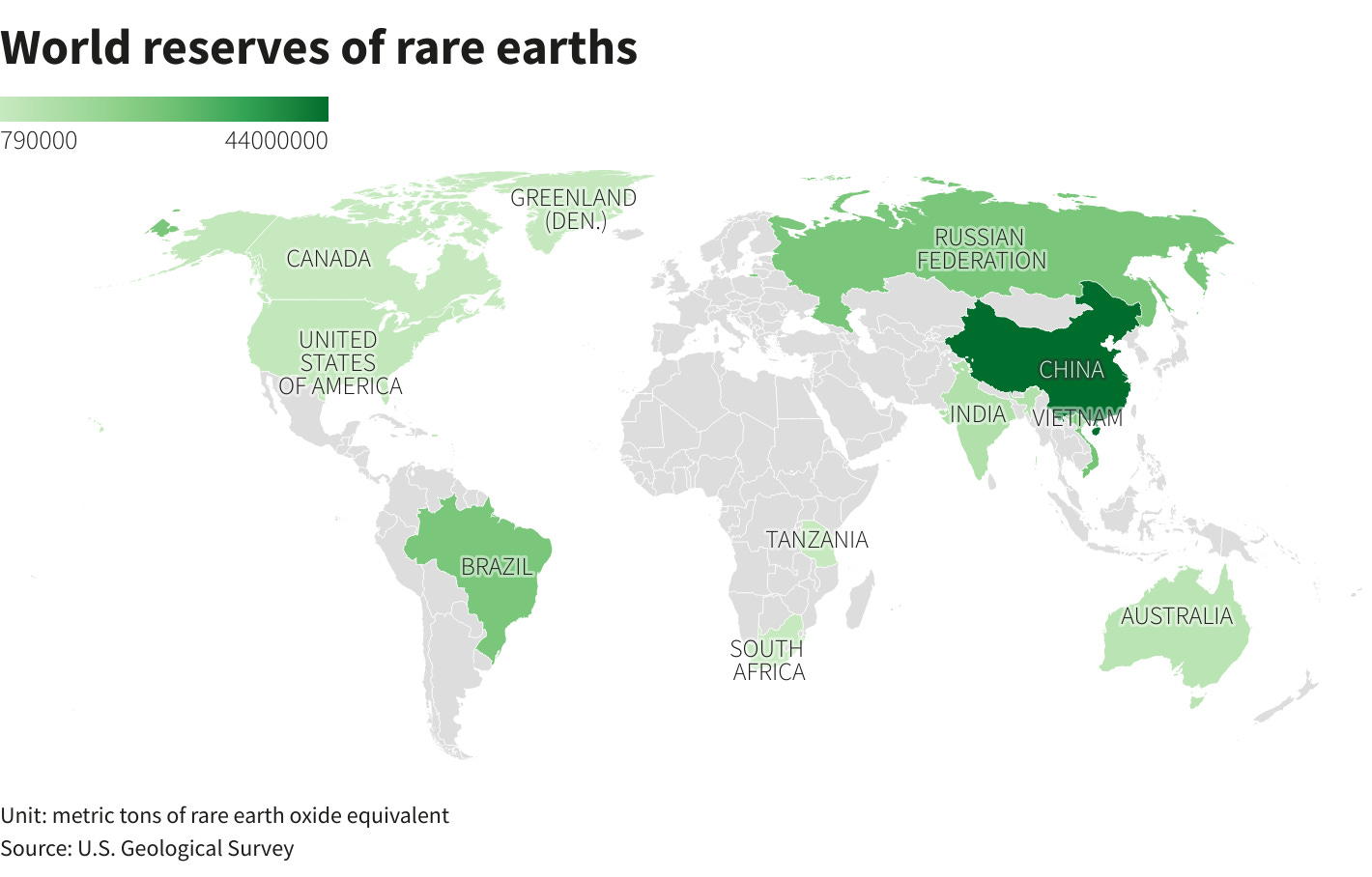

China commands 60% of global rare earth mining and 90%+ of processing—vital for everything from F-35 jets to iPhones—leaving the U.S. and Japan perilously exposed, as mapped in Reuters Graphics data. Their new framework promises joint mining, refining, and next-gen nuclear tech, a direct counterpunch to Beijing’s export curbs. It’s pragmatic realpolitik: Japan, once crippled by 2010’s rare earth embargo, now invests alongside America to diversify. But execution demands trillions and years—time neither has in abundance amid Taiwan tensions.

This pact arrives as Japan remilitarizes at warp speed. For decades a pacifist outlier, Tokyo’s spending has doubled since 2022, hitting 1.8% of GDP in fiscal 2025 and eyeing NATO’s 2% benchmark.

“Japan’s defense buildup is not just about numbers—it’s a cultural earthquake, shaking off 80 years of postwar restraint to face a predatory neighborhood.” — Sheila Smith, Council on Foreign Relations Japan Chair

SIPRI data underscores the shift: Japan now ranks 10th globally at $55 billion annually, up 49% since 2015, funding U.S.-compatible missiles and carriers. Takaichi, Abe’s ideological heir, pledges even more—aligning perfectly with Trump’s “pay your fair share” mantra.

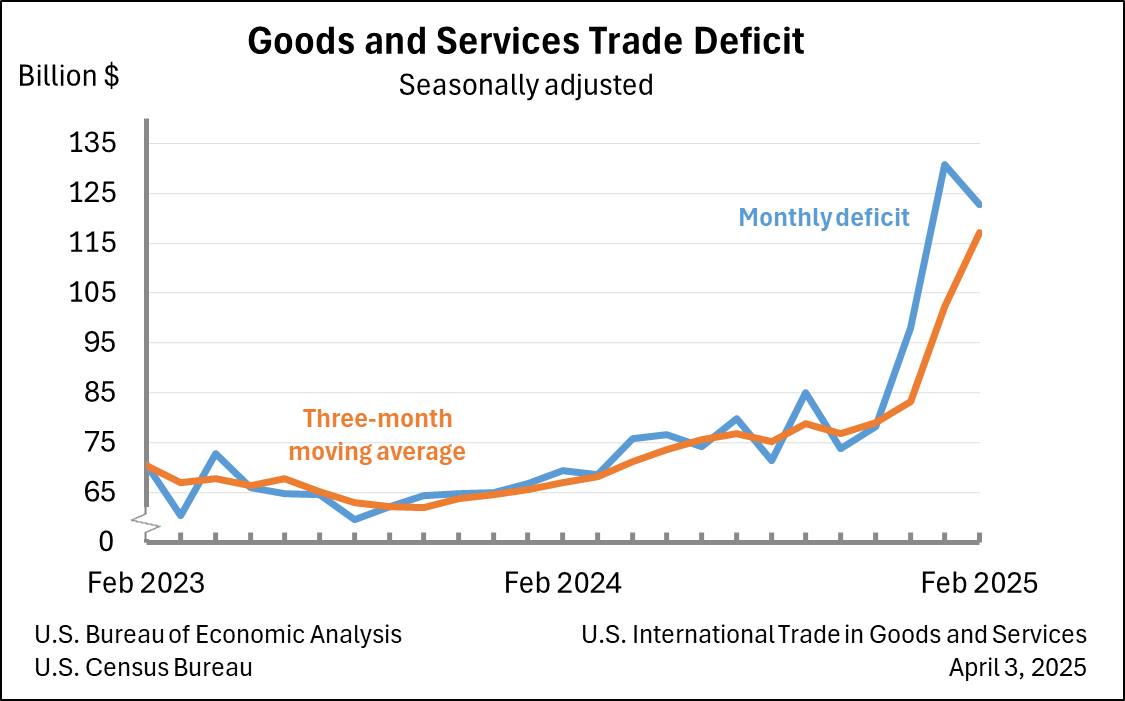

Yet alliance bliss masks economic friction. America’s goods deficit with Japan ballooned under auto tariffs, imports outpacing exports 2:1 at $128 billion vs. $64 billion yearly.

U.S. Bureau of Economic Analysis charts reveal the chasm: February’s deficit hit fresh highs, pressuring Trump to tout “fair” deals amid Toyota’s U.S. plants. Japan counters as America’s top foreign investor—$819 billion stock, employing 1 million—pouring into semiconductors and EVs.

“The U.S.-Japan bond is ironclad, but sustainability demands balance: America protects, Japan produces and pays.” — Shinzo Abe, in his final address to Congress (2019)

These numbers paint a maturing alliance: from postwar dependency to peer power-sharing. Trump’s charm offensive with Takaichi—first woman PM, conservative hawk—signals mutual respect, but realities loom. China’s shadow grows; tariffs bite; debts mount (Japan’s at 260% GDP). Success hinges on delivery: diversified minerals, burden-shared defense, rebalanced trade.

In a world of fractured supply chains and rising autocrats, the Trump-Takaichi summit isn’t diplomacy—it’s destiny’s pivot for two nations betting big on each other.

The US ~ Japanese relationship going forward is absolutely critical for world stability. A 'maturing relationship' is a solid term 💱 for the partnership.