We are being sold a story that our retirement savings are just a piggy bank for a down payment. But trading future security for present-day real estate isn’t ‘unlocking’ the American Dream—it’s cannibalizing it.

The Siren Call of the ‘Now’

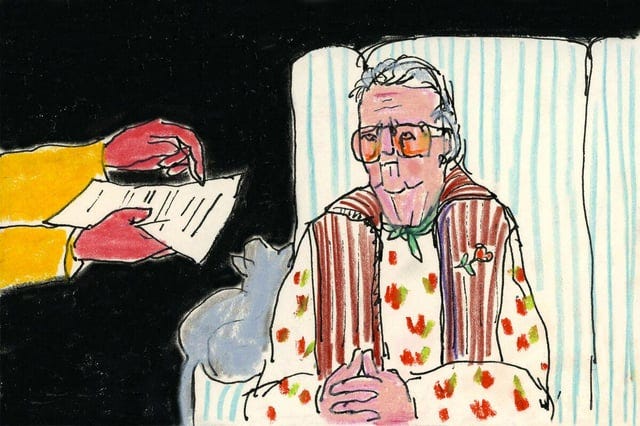

I want you to imagine the relief. You’ve been scraping by, watching home prices tick upward every month, feeling that pit in your stomach that says you’ve missed the boat. Then, someone hands you a key. They tell you that the money you’ve been stashing away for a gray-haired version of yourself is actually available now. It sounds like mercy. It sounds like the system finally working for you. The argument is incredibly persuasive: why starve today to feast in a future that isn’t guaranteed? It feels like we are finally prioritizing the living, breathing struggle of the present over the abstract actuarial tables of the future. It’s your money, after all. Why shouldn’t you use it to secure the one thing that supposedly guarantees stability? It’s a beautiful narrative of empowerment.

The Great Illusion of Wealth Transfer

But we have to look at what is actually happening beneath this emotional release. We aren’t solving the problem; we are just moving the pain around. When we treat retirement accounts as piggy banks for real estate, we aren’t creating wealth; we are engaging in a dangerous alchemy. We are transmuting liquid, diversified security into a single, immobile block of wood and stone. We are accepting a policy that encourages us to cannibalize our future dignity to pay for our present survival. It reminds me of the warning from the philosopher Simone Weil regarding our relationship with the future:

The future is made of the same stuff as the present.

– Simone Weil

If we consume the resources of the future to make the present palatable, we ensure that when the future arrives, it will be barren. We are not unlocking the American Dream; we are mortgaging our own timeline.

A Crisis of Supply, Masquerading as Finance

The tragic irony is that this won’t even make houses cheaper. It will make them more expensive. It’s basic economics: if you give everyone $50,000 more to spend on a house, but you don’t build any new houses, the price of every house just went up by $50,000. We are feeding the inflation monster with our own nest eggs. We are trapping ourselves in what Zygmunt Bauman described as the terrifying fluidity of modern life, where no ground is solid:

In a liquid modern life there are no permanent bonds, and any that we take up for a time must be tied loosely so that they can be untied again, as quickly and as effortlessly as possible, when circumstances change.

– Zygmunt Bauman, Liquid Modernity

By liquidating our long-term bonds (retirement) to buy into a volatile market, we are untying the only knot that held our future security together. We are trading the solid ground of savings for the shifting sands of a property bubble.

Go Deeper

Step beyond the surface. Unlock The Third Citizen’s full library of deep guides and frameworks — now with 10% off the annual plan for new members.

The Choice Before Us

This proposal is a test of our collective wisdom. Are we willing to demand the hard, structural changes that actually lower housing costs—zoning reform, fighting nimbyism, incentivizing construction? Or will we take the easy way out? The easy way feels good today. It gets you the keys. But it leaves the ‘future you’ vulnerable, exposed, and broke. We must resist the temptation to eat our seed corn. True financial citizenship means protecting the integrity of our entire lifespan, not just the moment of immediate desire.